Corporate

Application U/S 29A Of A&C Act Is Not Maintainable After Termination Of Proceedings Following Arbitrator's Withdrawal: Madras High Court

The Madras High Court held that section 29A of the Arbitration and Conciliation Act, 1996 (Arbitration Act) can be invoked only when the proceedings are pending. It cannot be invoked when the arbitral tribunal has become functus officio. Justice N. Anand Venkatesh held that “in the case in hand, the proceedings were abandoned and consequently stood terminated as was explained...

NBFC's Non-Compliance With RBI Directions Cannot Defeat Classification Of Loan As Financial Debt: NCLAT New Delhi

The NCLAT, Principal Bench, New Delhi, comprising Justice Ashok Bhushan (Chairperson) and Barun Mitra (Member-Technical), has held that the non-compliance with the RBI guidelines by an NBFC cannot defeat the classification of a loan as a financial debt u/s 7 of the IBC. Brief Background The appeal was filed challenging the impugned order passed by the NCLT Kolkata. In the...

NCLT Ahmedabad Admits Gensol-Linked Entity Blu-Smart Mobility Tech Into Insolvency

The National Company Law Tribunal (NCLT), Ahmedabad Bench, has recently admitted Blu-Smart Mobility Tech Pvt Ltd into Corporate Insolvency Resolution Process (CIRP) over an unpaid operational debt of ₹5.84 crore.The order , dated October 14, 2025 marks yet another Gensol-linked entity facing insolvency proceedings, following the admission of Gensol Engineering and Blu-Smart Mobility...

Under SARFAESI & RDB Acts, Dues Of Secured Creditors Take Precedence Over Govt Dues: Allahabad High Court

The Allahabad High Court has held that under Section 26-E of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Section 31B of the Recovery of Debts and Bankruptcy Act, 1993, the debts of the secured creditors will take precedence over all over debts including crown debts.The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar...

Assessment Order Not Void Solely Because It Was Passed in Deceased's Name: ITAT Chandigarh

The Income Tax Appellate Tribunal (ITAT), Chandigarh Bench, recently held that an appellate order passed by the Commissioner of Income Tax (CIT), reassessing the income tax liability of an assessee, is not invalid merely because it was issued in the name of a deceased person. The Tribunal noted that since the appeal itself was filed under the deceased's name, the order cannot be quashed on...

Mutually Contradictory Findings By Same Arbitrator At Different Stage Of Proceedings Renders Final Award Patently Illegal: Madras High Court

The Madras High Court held that declaring earlier proceedings non est, even when no objections were raised regarding the recording of the undertaking in those proceedings, constituted a perverse finding. The Court observed that such proceedings, which merely recorded an undertaking, could not fall within the ambit of Section 31 of the Arbitration and Conciliation Act, 1996 (Arbitration...

SEBI Impounds Rs 173.14 Crore In IEX Insider Trading Case After Alleged Leak Of Sensitive Information By CERC Official

The Securities and Exchange Board of India (SEBI) on Wednesday passed an ex-parte interim order impounding ₹173.14 crore from eight individuals for allegedly engaging in insider trading in the shares of Indian Energy Exchange Limited (IEX).The trades were allegedly based on unpublished price sensitive information (UPSI) leaked from the Central Electricity Regulatory Commission (CERC) by one...

Tax Demands Raised Post Approval Of IBC Resolution Plan Are Not Enforceable: Karnataka High Court

The Karnataka High Court recently reiterated that tax demands raised by revenue authorities after the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) are unenforceable if the claims were not submitted during the Corporate Insolvency Resolution Process (CIRP).A single bench of Justice M Nagaprasanna observed,“There is no jurisdiction to parallelly...

Show Cause Notice Cannot Be Issued Solely On Basis Of Voluntary Disclosure Under SVLDRS Scheme: CESTAT

The Bangalore Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that a show cause notice cannot be issued solely based on voluntary disclosure by the assessee under the SVLDRS Scheme [Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019]. The bench, consisting of P.A. Augustian (Judicial Member) and R. Bhagya Devi (Technical Member), agreed with...

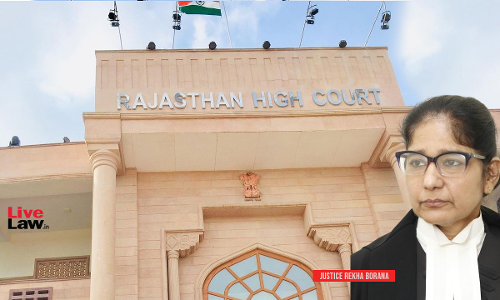

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification...

Objections U/S 47 CPC Can't Be Entertained In Enforcement Of Arbitral Awards U/S 36 Of A&C Act: Orissa High Court

The Orissa High Court has recently held that objections under Section 47 of the Code of Civil Procedure ('CPC') cannot be allowed to be raised in the enforcement proceeding of an arbitral award, as enunciated under the provision of Section 36 of the Arbitration and Conciliation Act, 1996 ('A & C Act').While bringing clarity as to applicability of Section 47 of CPC to arbitral proceedings,...

Mere Correction Of Typographical Error In Arbitral Award Does Not Extend Limitation Period For Plea U/S 34(3) Of A&C Act: Delhi HC

The Delhi High Court held that mere correction of typographical error does not extend the period limitation for filing a petition under section 34 of the Arbitration and Conciliation Act, 1996 (Arbitration Act). The court further held that the limitation period begins from the date of disposal of an application under section 33 of the Arbitration Act and not from the date when a...