Tax

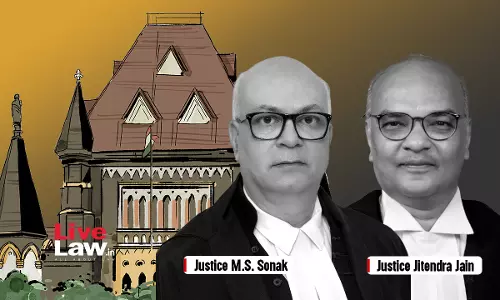

Pending Proceedings Under Omitted CGST Rules 89(4B) & 96(10) Lapse In Absence Of Savings Clause: Bombay High Court

The Bombay High Court has held that all pending proceedings under the omitted CGST Rules 89(4B) & 96(10) lapse in the absence of a savings clause. The bench agreed with the assessee/petitioners that the provisions of Section 6 of the General Clauses Act are not attracted and therefore the pending proceedings can claim no immunity or protection. Unless the Respondents...

Notice U/S 148 Income Tax Act Must Be Delivered To Addressee Personally By Post To Complete Service U/S 27: Allahabad High Court

The Allahabad High Court has held that notices under Section 148 and 282 of the Income tax Act, 1961 must be delivered to the assesee personally through speed post and not merely upon his address to complete service under Section 27 of the General Clauses Act, 1897. It held that presumption of sufficient service arises only when the notice is sent by registered post as in registered...

'Same Order Challenged Before Multiple Benches': CESTAT Refers Matter To President For Constitution Of Special Bench

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has directed the Registry to refer two appeals to the President of CESTAT for the constitution of a Special Bench to hear and decide the matter against a common order. Citing the principle of “comity of Courts,” the bench, consisting of Ajayan T.V. (Judicial Member) and M. Ajit Kumar (Technical...

Provisional Attachment Of Bank Accounts Cannot Be Done Merely Upon Issue Of Show Cause Notice U/S 74 GST Act: Allahabad High Court

The Allahabad High Court has held that provisional attachment of bank accounts cannot be done merely upon issue of show cause notice under Section 74 of the Goods and Service Tax Act, 2017. Referring to the judgment of the Supreme Court in Radha Krishan Industries v. State of H.P. and its earlier judgment in R.D. Enterprises v. Union of India, the bench of Justice Shekhar B....

White Petroleum Jelly Classified As 'Drug', Not Cosmetic; Higher VAT & Entry Tax Not Leviable: Madhya Pradesh High Court

The Madhya Pradesh High Court stated that White Petroleum Jelly is classified as a 'Drug', not 'Cosmetic', and therefore is not liable to higher VAT and Entry Tax. Justices Vivek Rusia and Jai Kumar Pillai stated that a White Petroleum Jelly of IP grade manufactured and sold by appellant under a valid drug licence is liable to be classified as a category of drug and medicine under...

No Tax Exemption On Bakery Products Sold At Snack Bar: Madras High Court

The Madras High Court held that there is no tax exemption for bakery products sold in a snack bar. Justices S.M. Subramaniam and C. Saravanan were addressing the issue of whether bakery products sold in a snack bar are covered under the notification G.O.P.No.570 dated 10th June 1987 and exempted from tax. The assessee/petitioner is running a restaurant in which they are involved...

CBDT Extends Due Date For Filing Tax Audit Reports To 31st October

On 25th September, the Central Board of Direct Taxes extended the specified date for filing various audit reports for the Previous Year 2024-25 (Assessment Year 2025-26), from 30th September 2025 to 31st October 2025, for assesses referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Income Tax Act,1961.The extension was granted after the Board received...

Karnataka High Court Directs CBDT To Extend Tax Audit Due Date To 31st October

The Karnataka High Court today directed the Central Board of Direct Taxes to extend the due date for filing Tax Audit Reports under Section 44AB of the Income Tax Act, 1961, by one month to 31st October, 2025.For reference: “Section 44AB of the Income Tax Act, 1961 mandates compulsory audit of accounts for businesses and professionals above a specified turnover or gross...

Allahabad High Court Issues Notice On Plea Challenging S.127 CGST Act Over 'Unbridled' Power Given To Authorities To Impose Penalty On Assessee

Recently, the Allahabad High Court has issued notices to office of the Solicitor General of India and Advocate General, Uttar Pradesh in a writ petition challenging the validity of Section 127 of the Central and State Goods and Service Tax Act, 2017. Section 127 of the Central and State Goods and Service Tax Act, 2017 empowers the proper officer to impose penalty when he is of the...

Does CESTAT Have Jurisdiction To Hear Challenge To Central Govt Notifications Imposing Anti-Dumping Duty? Delhi High Court To Examine

The Delhi High Court is set to examine whether the Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has jurisdiction to hear challenges to notifications issued by the Central Government, imposing Anti-Dumping Duty.Anti-dumping investigation determines whether a product is being dumped in the country at a lower price, causing material injury to the domestic industry. If found...

Rajasthan HC Grants One Month Extension For Filing Tax Audit Report After Complaints Of Glitches On E-Filing Portal

The Rajasthan High Court has extended the deadline for filing the Tax Audit Report by one month. A division bench of Justice (Dr.) Pushpendra Singh Bhati and Justice Bipin Gupta at the Rajasthan High Court extended the deadline under Section 44AB of the Income Tax Act, 1961, by 1 (one) month beyond September 30, 2025. It was submitted that in the previous years, CBDT had...

Income Tax Act | To Claim Deduction U/S 54F, Assessee Must Show Intention To Repay Borrowed Funds With Capital Gains: Kerala HC

The Kerala High Court stated that to claim the Section 54F deduction under the Income Tax Act, the assessee must satisfy the authorities that borrowed funds were used at their own risk with the intention to be repaid with capital gains. Section 54F of the Income Tax Act, 1961, allows a tax exemption on capital gains earned from selling a residential property, but only if certain...