Corporate

Tax Demands Raised Post Approval Of IBC Resolution Plan Are Not Enforceable: Karnataka High Court

The Karnataka High Court recently reiterated that tax demands raised by revenue authorities after the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) are unenforceable if the claims were not submitted during the Corporate Insolvency Resolution Process (CIRP).A single bench of Justice M Nagaprasanna observed,“There is no jurisdiction to parallelly...

Show Cause Notice Cannot Be Issued Solely On Basis Of Voluntary Disclosure Under SVLDRS Scheme: CESTAT

The Bangalore Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that a show cause notice cannot be issued solely based on voluntary disclosure by the assessee under the SVLDRS Scheme [Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019]. The bench, consisting of P.A. Augustian (Judicial Member) and R. Bhagya Devi (Technical Member), agreed with...

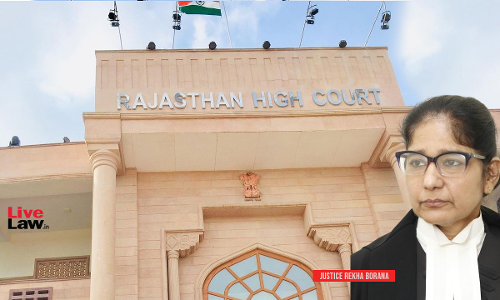

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification...

Objections U/S 47 CPC Can't Be Entertained In Enforcement Of Arbitral Awards U/S 36 Of A&C Act: Orissa High Court

The Orissa High Court has recently held that objections under Section 47 of the Code of Civil Procedure ('CPC') cannot be allowed to be raised in the enforcement proceeding of an arbitral award, as enunciated under the provision of Section 36 of the Arbitration and Conciliation Act, 1996 ('A & C Act').While bringing clarity as to applicability of Section 47 of CPC to arbitral proceedings,...

Mere Correction Of Typographical Error In Arbitral Award Does Not Extend Limitation Period For Plea U/S 34(3) Of A&C Act: Delhi HC

The Delhi High Court held that mere correction of typographical error does not extend the period limitation for filing a petition under section 34 of the Arbitration and Conciliation Act, 1996 (Arbitration Act). The court further held that the limitation period begins from the date of disposal of an application under section 33 of the Arbitration Act and not from the date when a...

Performance Of Every Contract Would Be Jeopardised If Partial Breakdown Of Machinery Is Considered 'Force Majeure' Event: Delhi High Court

The Delhi High Court partly set aside an arbitral award which directed the National Council of Educational Research and Training (NCERT) to refund of Rs. 2 crore to M/s Murli Industries Ltd. holding that the finding of the arbitrator that breakdown of a machinery constituted a force majeure event cannot be sustained. The court however upheld the arbitrator's finding that the time was...

S. 138 NI Act | Directors Can't Escape Liability For Cheque Dishonour Merely Because Company Is Declared Insolvent: Orissa High Court

The Orissa High Court has recently held that directors of a company cannot be absolved of their liability for the offence of cheque dishonour under Section 138 of the Negotiable Instruments Act, 1881 ('the NI Act') merely because the company was declared insolvent and a Resolution Professional was appointed under the Insolvency and Bankruptcy Code, 2016 ('the IBC').While determining the extent...

NCLT Mumbai Clears Yatra Online Ltd Subsidiaries' Merger With Parent Company

The National Company Law Tribunal (NCLT) at Mumbai, on Tuesday allowed a Scheme of Amalgamation involving Yatra Online Limited and six of its wholly owned subsidiaries.A coram comprising Judicial Member K R Saji Kumar and Technical Member Anil Raj Chellan allowed a plea filed under Sections 230 to 232 of the Companies Act, 2013, by the subsidiaries seeking sanction of the merger scheme....

NCLAT Asks HDFC To Confirm Status Of Penalty Deposit Made By Schlott Glass India After Dissolution By SC Due To Abuse Of Dominant Position

After the Supreme Court absolved the German glass maker Schott Glass India Pvt. Ltd. of charges of abusing its dominant position, the National Company Law Appellate Tribunal (NCLAT) on Wednesday directed HDFC Bank to furnish a certificate confirming the origin and status of a penalty deposit made by the company more than a decade ago.The deposit, made in 2012 pursuant to an order of the...

IBC - Speculative Investors Can't Be Permitted To Misuse Insolvency & Bankruptcy Code Proceedings: Supreme Court

In a significant observation aimed at curbing the growing misuse of the Insolvency and Bankruptcy Code (IBC) in the real estate sector, the Supreme Court has reiterated that the Code cannot be used as a tool by speculative investors seeking quick financial returns rather than the genuine revival of distressed companies or protection of real homebuyers.Emphasizing the remedial and...

“Descriptive & Generic”: Kerala High Court Sets Aside Injunction Granted Over Use Of 'Metal Industries' Trademark

The Kerala High Court has recently set aside an injunction granted to government company Metal Industries Limited against use of trade mark 'Metal Industries' after noting that the words metal and industries are generic and descriptive.Even though the company was the registered owner and long-term user of the trade mark 'Metal Industries', Justice C. Pratheep Kumar found that there was no...

Information Regarding GST Returns Of Company Cannot Be Disclosed Under RTI Act: Bombay High Court

The Bombay High Court on Tuesday (October 14) held that a company's Goods and Services Tax (GST) returns filing cannot be disclosed under the Right To Information (RTI) Act. Sitting at Aurangabad bench, single-judge Justice Arun Pednekar noted that section 158(1) of the GST Act prohibits disclosure of information of GST returns to third parties and that section 8(1)(j) of the RTI Act too...