- Home

- /

- High Courts

- /

- Allahabad High Court

- /

- Allahabad High Court Orders ED...

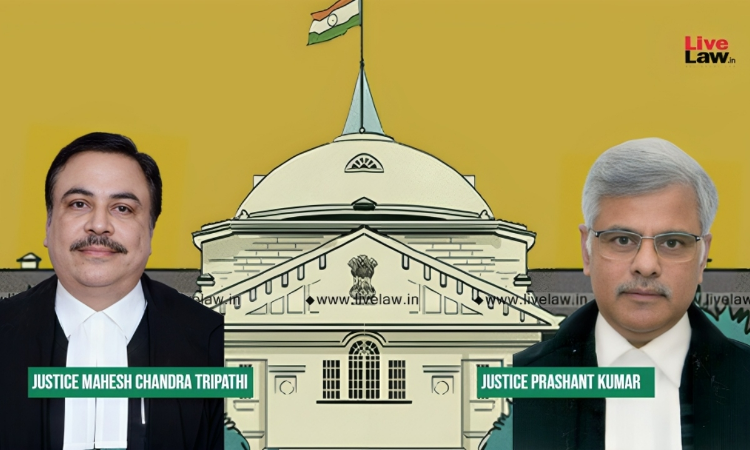

Allahabad High Court Orders ED Probe Into NOIDA Sports City Project, Questions Insolvency By Arena Superstructures Pvt Ltd

Kirit Singhania

5 Nov 2025 4:10 PM IST

In a ruling concerning the Sports City Project in Noida, a Division Bench of Justices Mahesh Chandra Tripathi and Prashant Kumar have ordered an investigation by the Enforcement Directorate (ED) into large-scale misappropriation, diversion of funds, land allotment scam and abuse of Insolvency Proceedings involving the Appellant Arena Superstructures Pvt. Ltd (ASPL) and a consortium...

In a ruling concerning the Sports City Project in Noida, a Division Bench of Justices Mahesh Chandra Tripathi and Prashant Kumar have ordered an investigation by the Enforcement Directorate (ED) into large-scale misappropriation, diversion of funds, land allotment scam and abuse of Insolvency Proceedings involving the Appellant Arena Superstructures Pvt. Ltd (ASPL) and a consortium of associated entities.

Tracing the factual background, the Court stated that the Sports City scheme launched by Noida Authority provided for the creation of integrated and multipurpose residential Sports City in Noida, known as Lotus Arena- I. Over the years, the project came into controversy due to irregularities in allotments, sub-leases and fund utilization by NOIDA. The Court found that the same set of promoters and ASPL had created multiple corporate companies to acquire large chunks of land, raise funds from homebuyers, and subsequently divert the funds, thereby leaving the project incomplete, due to sudden stoppage of work by ASPL.

The Court noted that:

“….virtually the same set of individuals floated multiple companies to procure leases from the Authority for the development of the Sports City Project as an integrated whole. However instead of discharging their obligation towards integrated development of the Project, the set of individuals who were effectively behind all the members of the Consortium, under the garb of being independent companies, only focused on residential development and completely ignored their responsibility for the development of sports facilities, and later got themselves in Insolvency”.

The Court found this act of ASPL to be a deliberate misuse of the corporate form to defraud stakeholders and applied the doctrine of piercing the corporate veil, observing that these entities could not hide behind the shield of company as a separate entity, when their actions were tainted by fraud and deceit.

Examining the insolvency proceedings, the Court observed how the Insolvency Code was invoked by ASPL before the NCLT, Delhi. The insolvency was admitted in 2020, and a resolution plan was later approved by NCLT in July 2023, permitting another entity, Purvanchal Projects Pvt. Ltd to take over as the Resolution Applicant and complete the project on time. The Court held that the insolvency process was itself not genuine but rather deliberate tactics by ASPL to escape its financial obligations. The Bench observed:

“This entire proceeding is nothing but an engineered insolvency to avoid the liabilities. The NCLT should verify from the balance sheet and other documents to ensure that such kind of engineered insolvency proceedings are not initiated if they are malicious or part of a greater design to get out of liabilities”.

The Court highlighted that insolvency mechanisms must be used for genuine corporate revival, not to subvert justice or deprive homebuyers of their rights.

While the Court criticized the conduct of the developers, it also made clear that its jurisdiction under Article 226 of the Constitution could not be used to substitute findings of the NCLT. Further, the Court issued a set of guidelines to prevent future recurrence of such deceitful practices in future:

- The NCLT must strictly verify from financial records and balance sheets whether insolvency petitions are 'genuine' or 'engineered' attempts to evade liabilities. Any collusive insolvency petitions should be rejected at the admission stage itself by the NCLT.

b. If multiple entities are controlled by the same promoters, the principle of piercing the corporate veil should be applied to hold them jointly accountable for misappropriation of funds and project delay.

- Independent financial audits must be conducted for stalled insolvency real estate projects to trace the flow of funds, before approving any resolution plan.

The Court then laid down a three-step procedure to be followed when a consortium member faces insolvency under the Code:

- The Interim Resolution Professional (IRP) must inform the company and the concerned Authority within 4 weeks of the initiation of insolvency proceedings to ascertain whether the company intends to continue fulfilling its obligations.

- If the IRP concludes that the insolvent company cannot participate, he must inform the other consortium members and Authority of the said project within the same 4-week period. The remaining members then have another 4 weeks to decide if they wish to continue and complete the project.

- If the consortium members fail to communicate their willingness to complete the project on their own and without the participation of the member facing CIRP or express their inability to complete the project, the Authority shall make alternate arrangements to ensure completion of the project.

In disposing of the writ petition, the Court directed an independent investigation by the ED to retrieve the siphoned money by the erstwhile management of the company.

Case Title: M/S Arena Superstructures Pvt Ltd and Another vs. State of U.P and Another

Case Number: WRIT – C No. – 6041 of 2024

Appearances:

For Petitioner: Ami Tandon

For Respondent: C.S.C, Kaushalendra Nath Singh