Bombay High Court

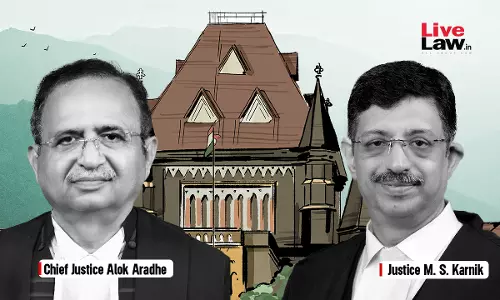

AO Cannot Alter Net Profit In Profit & Loss Account Except Under Explanation To S.115J Of Income Tax Act: Bombay High Court

The Bombay High Court stated that assessing officer do not have the jurisdiction to go behind net profit in profit and loss account except as per explanation to Section 115J Of Income Tax Act. The Division Bench consists of Chief Justice Alok Aradhe and Justice M.S. Karnik observed that “Section 115J of the 1961 Act mandates that in case of a company whose total income as...

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

Does Payment For Transponder Services Constitute 'Royalty' U/S 9(1)(vi) Of Income Tax Act? Bombay High Court Asks CIT To Decide

The Bombay High Court has asked the Commissioner of Income Tax to decide whether payment for transponder services constitutes 'royalty' under Section 9(1)(Vi) of Income Tax Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “the authorities have held the payment to constitute 'royalty' under the domestic law as well as under the Treaty, but by holding...

Bombay High Court Upholds Arbitral Award Against BCCI, Directs Payment Of ₹538.9 Crore To Defunct IPL Franchise Kochi Tuskers Kerala

The Bombay High Court has upheld an arbitral award granting damages amounting to 538.9 crore to Kochi Cricket Private Limited ("KCPL”), the parent company of defunct IPL franchise Kochi Tuskers Kerala.It was held that the Court cannot act as a Court of First Appeal and delve into a fact-finding exercise by revisiting and re-appreciating the record and accepting competing interpretations...

After Bombay High Court Intervenes, Housing Society Agrees To Remove Bouncers Appointed To Prevent Stray Dog Feeders

The Bombay High Court recently accepted the statement made by a housing society in Mumbai that it will remove bouncers, allegedly appointed for harassing members of the society, who fed street dogs in the society premises.A division bench of Justices Girish Kulkarni and Arif Doctor noted that by detailed orders passed on March 27 and March 28, 2023 and April 24, 2023, the society's committee...

Bombay High Court Weekly Round-Up: June 02 - June 08, 2025

Nominal Index [Citations: 2025 LiveLaw (Bom) 202 to 2025 LiveLaw (Bom) 205]Maharashtra Industrial Development Corporation vs Union Bank of India, 2025 LiveLaw (Bom) 202Hanuman Maruti Mandir Deosthan Trust vs Vina Yogesh Doke, 2025 LiveLaw (Bom) 203Hemang Jadavji Shah vs State of Maharashtra, 2025 LiveLaw (Bom) 204Alka Shrirang Chavan vs Hemchandra Rajaram Bhonsale, 2025 LiveLaw...

Nowadays Wife Thinks Police Complaint Is The Only Panacea To Teach A Lesson To Husband's Family Over Marital Discord: Bombay High Court

While quashing an FIR lodged against seven members of a family, the Nagpur bench of the Bombay High Court bemoaned the misuse of section 498A at the hands of women by roping in all the family members of the husband in criminal cases only to settle their personal scores. A division bench of Justices Anil Kilor and Pravin Patil expressed concern over such a tendency of women implicating all...

Murder Conviction Can't Be Converted To Culpable Homicide If Convict Was Cruel: Bombay High Court Denies Relief To Man Who Locked Burning Wife

The Bombay High Court recently refused to commute the conviction of a man from murder to culpable homicide not amounting to murder after noting that the convict acted in a 'cruel' manner by setting his wife ablaze and further not letting anyone to help her.A division bench of Justices Sarang Kotwal and Shyam Chandak said the convict Ambadas Aaretta acted in a cruel manner and took advantage...

Names Of Dead Persons Remaining On Voters List Doesn't Mean They Were Misused To Influence Election Result: Bombay High Court

Merely because names of dead persons continue to be on the voters list it cannot be presumed that votes have been cast in the name of these dead persons, held the Aurangabad bench of the Bombay High Court recently while upholding the election of Congress MP Shobha Bacchav from Dhule constituency to the 18th Lok Sabha elections.Single-judge Justice Arun Pednekar dismissed the election...

Treaty Provisions Don't Override Customs Law: Bombay High Court Upholds SCN Issued For Alleged Misuse Of Import Exemptions

The Bombay High Court stated that treaty provisions don't override customs law and upheld the show cause notices issued for alleged misuse of import exemptions. The Bench consists of Justices M.S. Sonak and Jitendra Jain observed that based on a treaty provision that is not transformed or incorporated into the national law or statute, the provisions of the existing Customs Act...

Cash Credit Account Cannot Be Treated As Property Of Account Holder Which Can Be Considered U/S 83 Of GST Act: Bombay High Court

The Bombay High Court stated that cash credit account cannot be treated as property of account holder which can be consider under Section 83 of GST Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that the phrase 'including bank account' following the phrase, “any property” would mean a non-cash-credit bank account. Therefore, a “cash credit...

Amount Of Subsidy Received By Assessee From RBI Cannot Be Treated As 'Interest' Chargeable U/S 4 Of Income Tax Act: Bombay High Court

The Bombay High Court held that the amount of subsidy received by the Assessee from RBI cannot be treated as 'interest' chargeable under Section 4 of Income Tax Act. The Division Bench of Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that “the amount of subsidy received by the Assessee is not relatable in loan or advance given by the assessee to the RBI and...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www-livelaw-in.demo.remotlog.com/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)