- Home

- /

- High Courts

- /

- Bombay High Court

- /

- 'Promise Of 10-15% Profit Per Month...

'Promise Of 10-15% Profit Per Month Shows Prima Facie Dishonest Intention': Bombay HC Declines Anticipatory Bail Plea In Trading Scam Case

Saksham Vaishya

20 Sept 2025 12:00 PM IST

The Bombay High Court has held that an assurance of abnormally high and guaranteed profits in intra-day share trading demonstrates prima facie dishonest intention at the inception, thereby attracting criminal liability. The Court observed that no genuine business can yield assured profits of 10–15% per month, and such inducements cannot be brushed aside as mere civil disputes.Justice...

The Bombay High Court has held that an assurance of abnormally high and guaranteed profits in intra-day share trading demonstrates prima facie dishonest intention at the inception, thereby attracting criminal liability. The Court observed that no genuine business can yield assured profits of 10–15% per month, and such inducements cannot be brushed aside as mere civil disputes.

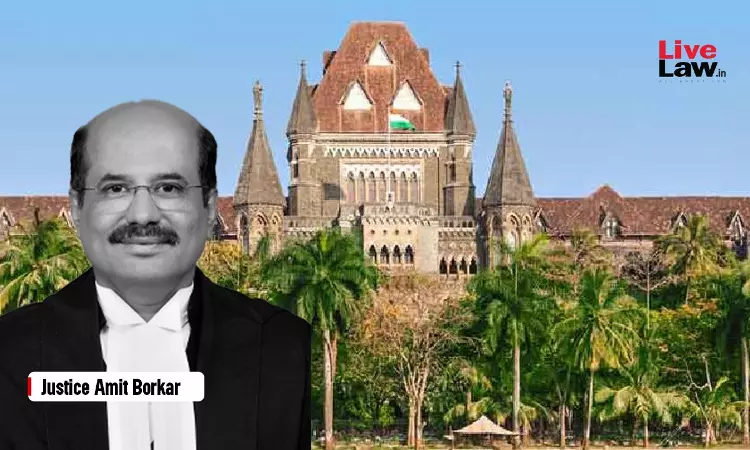

Justice Amit Borkar was hearing an anticipatory bail application filed apprehending arrest for offences under Sections 318(4) and 3(5) of the Bharatiya Nyaya Sanhita, 2023. The applicants were accused of inducing the complainant, an advocate, to invest Rs. 30 lakh in share trading with assurances of 10–15% monthly profit. Though they initially paid Rs. 4 lakh as profit and issued a security cheque of Rs. 25 lakh, they failed to return the money.

“… every breach of contract does not amount to cheating. However, when dishonest intention exists at the inception and inducement is made with false promises that cannot be realistically fulfilled, the offence of cheating is attracted… the promise of 10% to 15% monthly profit in intraday trading is, on the face of it, a false assurance, as no genuine or lawful business can guarantee such returns. Hence, the element of criminality cannot be brushed aside,” the Court observed.

The applicants contended that the dispute was civil in nature, arising out of professional rivalry in a law firm they had jointly established with the complainant, and that they had repaid more than the alleged investment. They argued that the complainant invested fully aware of trading risks, and dishonest intention was absent.

The Court held that the promise of such extraordinary profits itself reflected fraudulent intent at the outset. It noted that inducement based on assurances inherently impossible to fulfil attracts the offence of cheating, and the defence of a purely civil dispute could not be accepted.

“… where inducement is coupled with an assurance which is inherently impossible to fulfil, the offence of cheating comes into play. It is not necessary for the Court to record a conclusive finding at this stage, but it is sufficient to notice that the allegations disclose ingredients of a criminal offence,” the Court observed

The Court noted that a prima facie evaluation of the material evinces that the case does not rest upon a simple breach of contract or dissolution of partnership. The manner in which the money was collected, the promise of guaranteed profit, and the subsequent conduct of the applicants in avoiding repayment together disclose fraudulent intention at the inception.

The Court also took serious note of the fact that both parties were practising advocates, and that one of the applicants had admitted in writing to receiving over Rs. 26 lakh for “liaisoning work” with revenue authorities, holding that such conduct makes the element of illegality and criminality evident.

Observing that the case disclosed a pattern of inducement, receipt of funds, and default involving multiple victims, the Court found that custodial interrogation was necessary to ascertain the utilisation of funds. Hence, it dismissed the anticipatory bail application.

Case Title: Rupali Bapurao Jadhav & Anr. v. State of Maharashtra [Anticipatory Bail Application No. 2042 of 2025]