- Home

- /

- High Courts

- /

- Bombay High Court

- /

- Order U/S 53A(1) Of Maharashtra...

Order U/S 53A(1) Of Maharashtra Stamp Act Must Be Passed Within Six Years From Date Of Issuing Certificate For Adjudication: High Court

Saksham Vaishya

19 Aug 2025 4:35 PM IST

The Bombay High Court has held that an order under Section 53A(1) of the Bombay/Maharashtra Stamp Act, 1958 must be passed within a period of six years from the date of issuance of the certificate of adjudication under Section 32. It ruled that merely initiating proceedings within six years is not enough, as the final order itself has to be made within that period.Justice Jitendra Jain...

The Bombay High Court has held that an order under Section 53A(1) of the Bombay/Maharashtra Stamp Act, 1958 must be passed within a period of six years from the date of issuance of the certificate of adjudication under Section 32. It ruled that merely initiating proceedings within six years is not enough, as the final order itself has to be made within that period.

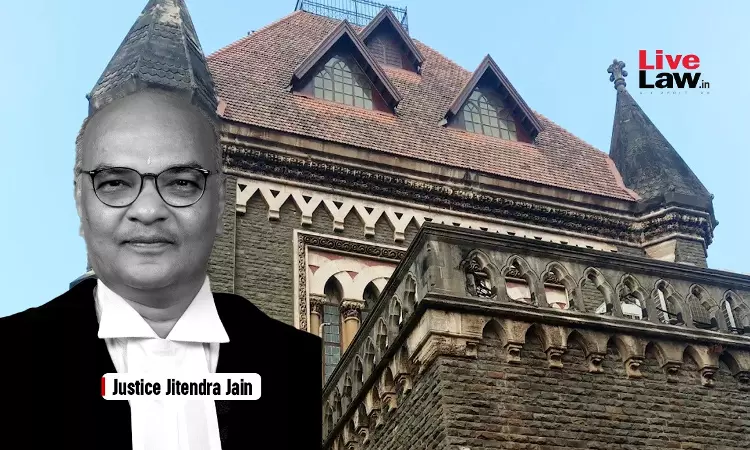

Justice Jitendra Jain was hearing a writ petition filed by Sony Mony Electronics Ltd. challenging the order of the Chief Controlling Revenue Authority directing payment of deficit stamp duty nearly nine years after the adjudication certificate had been issued. The petitioner argued that the action was barred by limitation under the clear language of Section 53A(1).

The respondents contended that the requirement was only to initiate the proceedings within six years, and that the order could be passed later. They relied on notices issued within the limitation period to argue that the subsequent order was valid.

The Court rejected this argument, holding that the statute uses the word “and”, which makes it mandatory that both initiation and passing of the final order must be within six years. It observed:

“… the first part and third part are connected with the conjunctive word “and” and consequently, the period of 6 years provided in Section 53A(1) should be read to mean that the order of recovery should be passed within the said time frame.”

In support of this interpretation, the Court referred to analogous provisions such as Section 32C of the Stamp Act, which also prescribes a definite time frame for final orders. The Court held that in the absence of any specific timeline for passing an order under S. 53A(1), the intention to keep the timeline of six years should be presumed. It noted that allowing revenue authorities to pass orders beyond the prescribed period would lead to uncertainty, which is contrary to the canons of any fiscal legislation.

The Court further opined that the “reasonable period” to conclude the proceedings under Section 53A(1) after initiation of the proceedings would be a maximum of 2 years. It observed:

“Section 32C of the Stamp Act provides for issuing notice for revision within 3 years from the date of communication of the order sought to be revised and to pass the order of revision before the expiry of 5 years from the date of the order sought to be revised. Thereby, the Scheme of the Act dealing with a similar provision gives a period of 2 years (5 years minus 3 years) for completion of the proceedings.”

Hence, the Court concluded that the impugned order dated 14 August 2012 cannot be said to have been passed within the limitation period of 6 years provided under Section 53A(1) of the Stamp Act nor within reasonable period from the issue of notice under Section 53A(1) or within reasonable time from the expiry of the 6 years period.

Accordingly, the Court quashed the impugned order.

Case Title: Sony Mony Electronics Ltd. v. State of Maharashtra & Anr. [WRIT PETITION NO. 2757 OF 2012]