- Home

- /

- High Courts

- /

- Bombay High Court

- /

- Income Tax | Sale Proceeds Of...

Income Tax | Sale Proceeds Of Vintage Cars Taxable Unless Assessee Proves That Car Was Used As Personal Asset: Bombay High Court

Mehak Dhiman

19 Aug 2025 10:36 AM IST

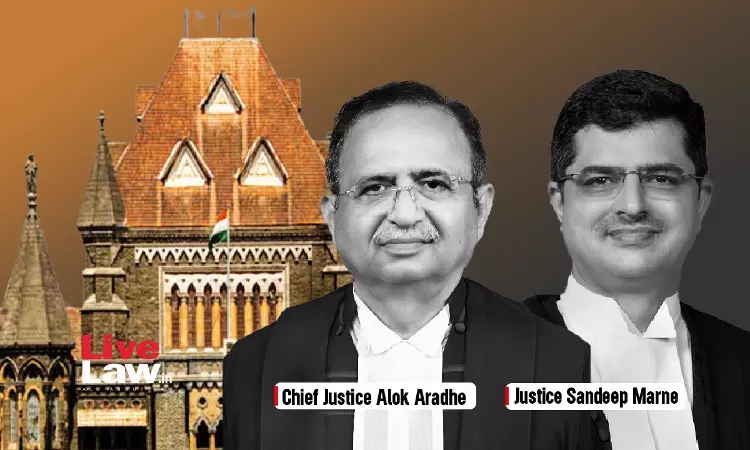

The Bombay High Court held that sale proceeds of vintage car taxable unless the assessee proves that the car was used as a personal asset. Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that the capability of a car for personal use would not ipso facto lead to automatic presumption that every car would be personal effects for being excluded from capital assets of...

The Bombay High Court held that sale proceeds of vintage car taxable unless the assessee proves that the car was used as a personal asset.

Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that the capability of a car for personal use would not ipso facto lead to automatic presumption that every car would be personal effects for being excluded from capital assets of the Assessee.

In this case, the Assessee had purchased a vintage car for a consideration of Rs.20,000/-. The said car was sold for a consideration of Rs.21,00,000/-.

The Assessee apprised the Assessing Officer that the car was shown as a personal asset in Wealth-tax and same was an exempt asset. The Assessing Officer, added the sum of Rs.20,80,000/- as income to the Assessee on account of sale of motor car as business income.

The Assessee thereupon filed a The Assessee thereupon filed an Appeal. The Commissioner of Income Tax (Appeals) [CIT (A)] held that vintage cars are not generally used frequently as maintenance costs of these cars are very high. The car was shown as personal asset in wealth tax returns.

The Commissioner of Income Tax (Appeals), set aside the deletion of sum of Rs.20,80,000/- under the head 'profits from sale of car'. Accordingly, the Appeal was partly allowed.

Being aggrieved by the order passed by the Commissioner of Income Tax (Appeals), the Revenue preferred an Appeal before the Income Tax Appellate Tribunal (ITAT).

The ITAT reversed the finding of CIT (A) and held that the vintage car was not used by the Assessee as personal effect. The order passed by the CIT (A) was set aside by the ITAT and the Appeal preferred by the Revenue was allowed.

The assessee submitted that the Tribunal has not disputed or controverted any of the basic facts or arguments of the Assessee that the car was being accepted as personal asset by the department itself and the maintenance expenses were debited to the capital account as part of personal withdrawals.

The bench stated that the Assessee has failed to adduce any evidence with regard to the vintage car being put to personal use and therefore the Tribunal has rightly reversed the order passed by the Commissioner of Income Tax (Appeals), which had applied irrelevant considerations of wealth tax returns and non-claiming of depreciation in respect of the car by the Assessee.

The bench opined that what needed to be proved is that the car was used as a personal asset by the Assessee. It was therefore incumbent upon the Assessee to lead evidence to show that he actually used the car personally. It is an admitted position that the Assessee failed to adduce evidence to prove that the car was used personally by him.

In view of the above, the bench dismissed the appeal.

Case Title: Narendra I. Bhuva v. Assistant Commissioner of Income Tax

Case Number: INCOME TAX APPEAL NO.681 OF 2003

Counsel for Appellant/Assessee: Vipul Joshi with Prashant Ghumare

Counsel for Respondent/Department: Prakash C. Chhotaray with Sangita Choure