- Home

- /

- High Courts

- /

- Bombay High Court

- /

- Prior IBC Proceedings Don't Bar...

Prior IBC Proceedings Don't Bar Criminal Prosecution Of Directors Under S. 138 Negotiable Instruments Act: Bombay High Court

Mohd.Rehan Ali

7 Oct 2025 10:18 AM IST

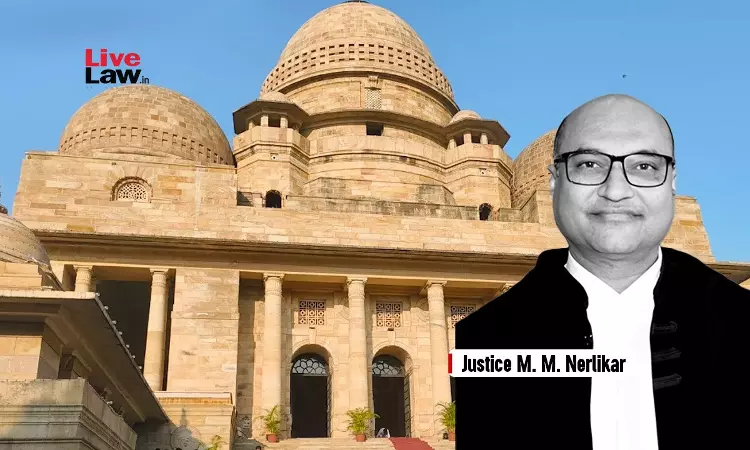

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act. Background of the Case The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as...

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act.

Background of the Case

The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as a security by the director. The NCLT admitted the respondent company into the CIRP, and its failure resulted in the liquidation order. The petitioner lodged its claim with the interim resolution professional.

The petitioner deposited the cheque after the moratorium date; however, the same was dishonored due to insufficient funds. Therefore, the petitioner filed the complaint u/s 138 of the NI Act. The trial court dismissed the complaint, holding that the complaint is non-maintainable due to prior insolvency proceedings. Therefore, the petitioner approached the Hon'ble High Court under the writ jurisdiction.

Contention of the Parties

The petitioner contended that the proceedings under the IBC and NI Act are quite distinct and operate in different spheres. It highlighted that the provision of the NI Act is penal in nature, which is distinct from the recovery. It also contended that the approval of the resolution plan does not rescue the directors from penal action u/s 138 NI Act.

Per contra, the respondent submitted that the cause of action arose after the imposition of the moratorium; therefore, the NI Act proceedings would not be tenable against the directors.

While placing reliance on the Supreme Court's ruling in the case of VishnooMittal v. M/s. Shakti Trading Company, the respondent argued that once the proceedings under the IBC have been initiated, it bars the initiation of proceedings u/s 138 NI Act.

Observations of the High Court

The bench discussed section 32A of the IBC and observed that the provision bars prosecution of the corporate debtor for offenses committed prior to the commencement of the CIRP. But there is an exception that says that the prosecution against the natural person will continue.

The bench observed that the ruling of Vishnoo (Supra) bars the initiation of section 138 NI Act proceedings post initiation of CIRP. However, the ruling of P. Mohanraj, Ajay Kumar and Rakesh Bhanot, clarified that the moratorium under section 14 IBC would apply only to the corporate debtor, and the natural person mentioned u/s 141 would still be liable.

Furthermore, the bench clarified that the proceedings u/s 138 NI Act are not a recovery proceeding. Therefore, it makes no difference whether the proceedings are initiated prior to initiation of IBC proceedings or thereafter.

Furthermore, the bench discussed that the Supreme Court has in unequivocal terms held that natural persons cannot escape from their personal liability under Section 138 of the NI Act. It is further held that Section 138 proceedings in relation to the signatories who are liable or covered by the two provisos to Section 32A(1) will continue in accordance with law.

Case Name: Ortho Relief Hospital and Research v. M/s. Anand Distilleries, through its Directors & Anr.

Case No.: CRIMINAL WRIT PETITION No. 251 OF 2025.

For Petitioner: Mr. S.S. Dewani

For Respondents: Mr. S.D. Khati

Judgment Date: October 01, 2025