- Home

- /

- Labour & Service

- /

- Calcutta High Court Upholds...

Calcutta High Court Upholds Gratuity Entitlement Despite Corporate Insolvency Proceedings

Pranav Kumar

4 March 2025 8:51 AM IST

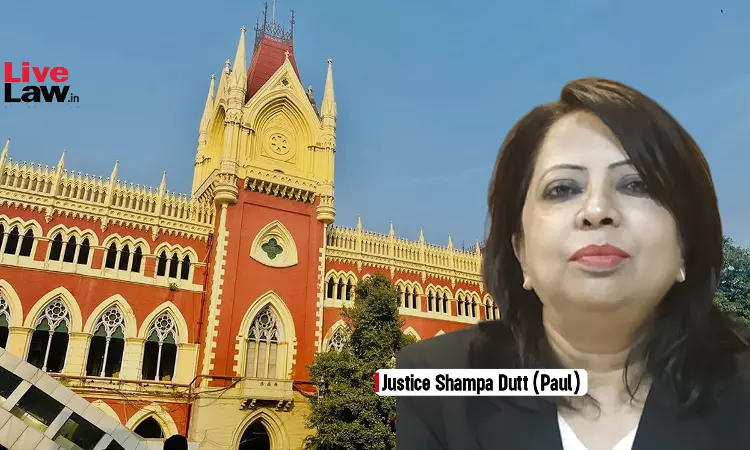

Calcutta High Court: A Single Judge Bench of Justice Shampa Dutt (Paul) dismissed a writ petition challenging an order directing the payment of gratuity to an employee. The court ruled that gratuity payments remain a statutory obligation even after a company undergoes Corporate Insolvency Resolution Process (CIRP). It held that Section 36(4)(a)(iii) of the Insolvency and Bankruptcy...

Calcutta High Court: A Single Judge Bench of Justice Shampa Dutt (Paul) dismissed a writ petition challenging an order directing the payment of gratuity to an employee. The court ruled that gratuity payments remain a statutory obligation even after a company undergoes Corporate Insolvency Resolution Process (CIRP). It held that Section 36(4)(a)(iii) of the Insolvency and Bankruptcy Code explicitly excludes gratuity funds from forming part of the corporate debtor's estate. Lastly, the court noted that CIRP merely facilitates a change in management and does not extinguish a company's obligations under the labor laws.

Background

Stesalit Limited had undergone a change in management following the Corporate Insolvency Resolution Process (CIRP) proceedings conducted under the Insolvency and Bankruptcy Code. During the CIRP, Arun Roy, a former Manager (Technical Operations) submitted a claim for gratuity. Roy had served the company from 18.09.2002 until his resignation on 03.12.2014. His claim was admitted by the Interim Resolution Professional (IRP), and the IRP also awarded him Rs. 38,808.43 under the approved resolution plan. Despite this, Roy initiated proceedings under the Payment of Gratuity Act, 1972. The Controlling Authority ruled in his favor, and directed Stesalit Limited to pay gratuity to Roy.

Aggrieved, Stesalit Limited challenged the Controlling Authority's order. They contended that the payment obligations under the resolution plan were final. They argued that a separate claim under the Payment of Gratuity Act amounted to forum shopping.

Arguments

Counsel for Stesalit Limited argued that since the company had been taken over under CIRP, Roy's claim for gratuity had already been settled under the resolution plan. They contended that the provisions of the IBC override all other laws. They claimed that any additional claims under the Payment of Gratuity Act would be impermissible. Thus, they submitted that the controlling authority lacked jurisdiction to entertain the gratuity claim.

On the other hand, Roy argued that gratuity is a statutory right under the Payment of Gratuity Act. Section 36(4) of the IBC specifically excludes gratuity dues from forming part of the liquidation estate. Relying on Hindustan Newsprint Limited and Jet Aircraft Maintenance Engineers Welfare Association v. Ashish Chhawchharia RP of Jet Airways (India) Ltd, he argued that gratuity must be paid in full and cannot be treated as corporate assets.

Court's Findings

Firstly, the court held that gratuity payments are distinct from other liabilities under the IBC. It noted that Section 36(4)(a)(iii), IBC, specifically excludes gratuity funds from forming part of the corporate debtor's estate. Citing Savan Godiwala v. Apalla Siva Kumar, the court reiterated that an employer's failure to maintain a gratuity fund does not absolve it from any liability owed to the employees.

Secondly, the court observed that Stesalit Limited had never been liquidated. CIRP merely facilitated a change in management. It did not extinguish the company's obligations under labor laws. Noting that the Payment of Gratuity Act applies to all employees irrespective of a company's financial restructuring, the court ruled that the controlling authority had jurisdiction to entertain Roy's claim.

Thirdly, the court rejected the company's argument that Roy's claim constituted forum shopping. The court noted that the approved resolution plan had only awarded a partial sum. It observed that the statutory entitlement under the Payment of Gratuity Act remained unfulfilled. Thus, the court held that the controlling authority was justified in directing full payment with interest.

Lastly, the court emphasized that Section 14 of the Payment of Gratuity Act confers it with overriding effect over any inconsistent laws. It held that the failure of the new management to account for gratuity liabilities in its resolution plan did not affect the statutory rights of employees. The court explained that CIRP does not shield corporate debtors from their obligations under welfare legislation.

Thus, the court dismissed the writ petition. It upheld the order directing Stesalit Limited to pay Rs. 2,11,154/- in gratuity along with 10% simple interest per annum.

Decided on: 21.02.2025

Case No.: WPA 532 of 2025 | M/s. Stesalit Limited v. Union of India & Ors.

Counsel for the Petitioner: Mr. Jishnu Chowdhury, Sr. Adv., Mr. Divyakant Lahoti, Ms. Shrinalli Kajaria, Mr. Vijay Kumar, Ms. Pramena Bisht, Mr. Madhus Jhaver, Mr. Siddharth Tripathi

Counsel for the Respondent No. 4: Mr. Subhash Chandra Sarkar