- Home

- /

- Supreme court

- /

- Bank's Failure To Disclose...

Bank's Failure To Disclose Encumbrances Of Property In Auction Notice Invalidates Sale : Supreme Court Orders Refund To Auction Purchaser

Yash Mittal

26 Sept 2025 10:20 AM IST

The Supreme Court on Thursday (Sep.25) quashed the auction by the Corporation Bank of a prime property located in Delhi, as the Bank failed to disclose the liability attached to the property in the e-auction. The bench of Justices Sanjay Kumar and Alok Aradhe emphasized that strict adherence to procedural safeguards is mandatory in public auctions to ensure the integrity of the debt...

The Supreme Court on Thursday (Sep.25) quashed the auction by the Corporation Bank of a prime property located in Delhi, as the Bank failed to disclose the liability attached to the property in the e-auction.

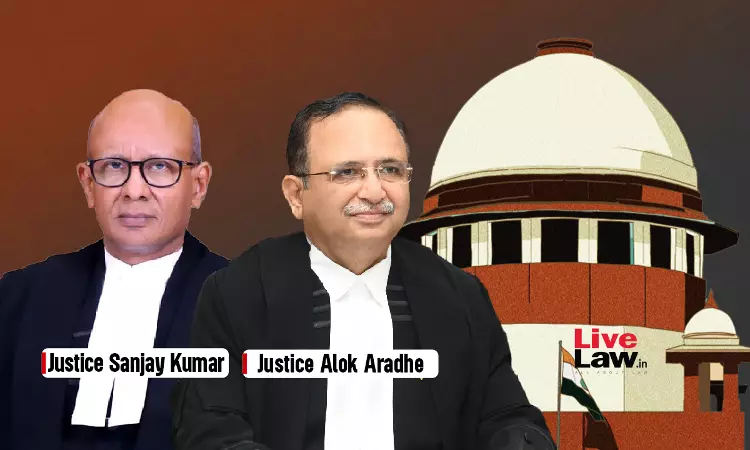

The bench of Justices Sanjay Kumar and Alok Aradhe emphasized that strict adherence to procedural safeguards is mandatory in public auctions to ensure the integrity of the debt recovery system and maintain public confidence in court-mandated sales.

It was the case where the Delhi Development Authority (“DDA”) has allotted a land to a private club to construct amenities. The club then secured loan through the Respondent-Corporation Bank keeping the land mortgaged with the Bank without obtaining consent from the Lieutenant Governor. An e-auction notice for sale of the mortgaged land was released by the Bank but it failed to state all material particulars, including encumbrances.

Uninformed about the encumbrances attached to the land, which include payment of unearned increase of price to the DDA, the auction purchaser purchased the land in e-auction without being aware of this obligation. This omission violated Rule 53 of the Second Schedule to the Income Tax Act, 1961, claimed the DDA, which filed a Writ Petition before the Delhi High Court challenging the auction. However,the petition was dismissed by the High Court, prop after its dismissal led DDA to appeal before the Supreme Court.

Second and Third Schedules to the Income Tax Act, 1961 and the Income Tax (Certificate Proceedings) Rules, apply with necessary modifications to the auction proceedings under the Recovery of Debts Due to Banks Act 1993 by virtue of Section 29. Rule 53 of Second Schedule to 1961 Act deals with contents of proclamation of sale.

Setting aside the High Court's decision, the judgment authored by Justice Aradhe observed that the e-auction was misleading and incomplete, as 'no sanctity can be attached to the e-auction sale' because bidders were deprived of knowledge about a significant liability that could drastically affect the property's value. The successful bidder had offered ₹13.15 crore without being aware of this obligation, which was inherently unfair.

“An e-auction notice was issued on 27.09.2012. In the said e-auction notice, sale price was fixed at Rs.8.85 crores. However, the fact that DDA has an encumbrance i.e. the claim for an amount of unearned increase in respect of subject plot was not disclosed in the e-auction. The Bank also failed to disclose the terms and conditions of the lease executed between the DDA and the Club, to the Recovery Officer which, it was under an obligation to do so in view of the statement made by it before the High Court, as recorded in the order dated 05.11.2012 pass in W.P. (C) No. 6972 of 2012. Thus, it is evident that e-auction notice was issued in violation of Rule 53 of the Second Schedule to the 1961 Act as well as Rule 16 of the Rules, 1962. Therefore, no sanctity can be attached to the e-auction sale notice and proclamation of sale dated 27.09.2012 as well as confirmation of sale and sale certificate dated 08.07.2013 and 12.07.2013 respectively issued in favour of the Auction Purchaser.”, the court observed.

Resultantly, the appeal was allowed, and the Court directed the Respondent-Bank to return the entire amount submitted by the auction purchaser by declaring the entire e-auction as void, to restore him to its original position by applying the doctrine of unjust enrichment.

"The principle of restitution flows from the very heart of justice that no one shall unjustly enrich himself at the instance of another and that those who suffered without fault should, so far as money can achieve, be restored to the position they once occupied. The jurisdiction to make restitution is inherent in every court and will be exercised wherever the justice of the case demands," the Court observed.

Directing the bank to retun the money to the auction-purchaser, the Court observed :

"The Bank having advanced the money of an illegal mortgage and having chosen to auction what it never lawfully possessed, bears the responsibility for the consequences."

Cause Title: DELHI DEVELOPMENT AUTHORITY Versus CORPORATION BANK & ORS.

Citation : 2025 LiveLaw (SC) 953

Click here to read/download the judgment

Appearance:

For Appellant(s) : Mr. C. Mohan Rao, Sr. Adv. Ms. Deeksha Ladi Kakar, AOR

For Respondent(s) : Mr. Arun Aggarwal, AOR Ms. Anshika Agarwal, Adv. Mr. Lovelesh Kukreja, Adv. Mr. Preetesh Kapur, Sr. Adv. Mr. Bikash Mohanty, Adv. Ms. Pallavi Sharma, AOR Mr. Apratim Thakur, Adv. Mr. Shashwat Panda, Adv. Mr. Aiman Zameer, Adv.