- Home

- /

- Supreme court

- /

- Customs Act | Electronic Evidence...

Customs Act | Electronic Evidence Admissible Without S.138C(4) Certificate If Assessee's S.108 Statement Admits Contents : Supreme Court

Yash Mittal

1 Sept 2025 4:49 PM IST

The Supreme Court recently held that electronic evidence seized by the Directorate of Revenue Intelligence (“DRI”) can be admissible even without a certificate under Section 138C(4) of the Customs Act, if the assessees has acknowledged these the documents in the devices in their statements under Section 108 of the Customs Act.Section 138C (4) of the Customs Act requires the production of...

The Supreme Court recently held that electronic evidence seized by the Directorate of Revenue Intelligence (“DRI”) can be admissible even without a certificate under Section 138C(4) of the Customs Act, if the assessees has acknowledged these the documents in the devices in their statements under Section 108 of the Customs Act.

Section 138C (4) of the Customs Act requires the production of a certificate, similar to the mandate under Section 65B (4) of the Evidence Act for proving electronic evidence.

Here, the Court clarified that where obtaining such a certificate is impossible, and the Record of Proceedings has been duly acknowledged by the assessee, the evidence collected cannot be treated as inadmissible merely for want of the formal certificate. If there is due compliance otherwise, the electronic evidene can be admitted.

“When we say due compliance, the same should not mean that a particular certificate stricto senso in accordance with Section 138C (4) must necessarily be on record. The various documents on record in the form of record of proceedings and the statements recorded under Section 108 of the Act, 1962 could be said to be due compliance of Section 138C (4) of the Act, 1962.”, the Court said.

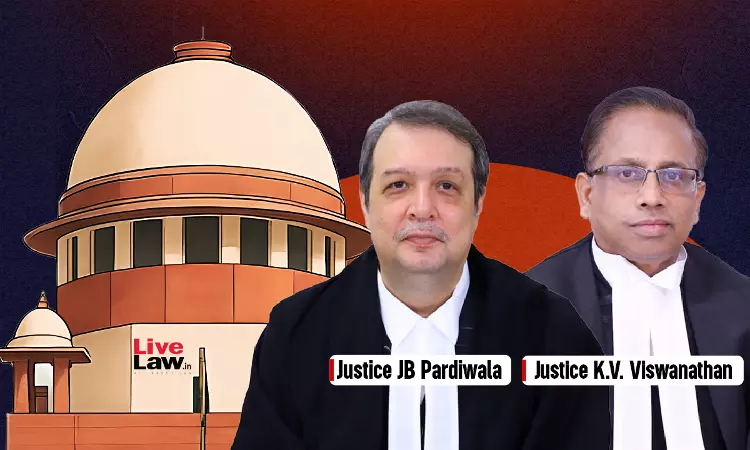

The bench comprising Justices JB Pardiwala and KV Viswanathan heard the case where the DRI alleged that the respondent company had under-declared the Retail Sale Price/Maximum Retail Price (RSP/MRP) of imported branded food items, leading to a customs duty evasion of over ₹9 crores. Electronic records retrieved from laptops and hard drives during searches formed the cornerstone of the case.

The Adjudicating Authority upheld the DRI's claims, but CESTAT quashed the order, holding the evidence inadmissible for lack of a Section 138C (4) certificate, relying on Anvar P.V. v. P.K. Basheer.

In appeal, the DRI contended that the documents collected from the electronic devices owned by the assessees at the time of search have been duly acknowledged by the assessees in their statements recorded under Section 108 of the Act, 1962. The DRI pointed out that the assesses have siged the Record of Proceedings which recorded the print outs from the hardisks seized from the assessees' premises. In the statemetns under S.108, the assessess said that they have put their signaturs on the pages of the print-outs as a token of their authenticity.

Overturning the CESTAT's order, the Court noted that the DRI had carefully recorded the seizure and printing process in the presence of the Respondent-company's directors, who signed every page and confirmed the accuracy of the records in their unretracted statements under Section 108 of the Customs Act. Relying on Arjun Panditrao Khotkar v. Kailash Kushanrao Gorantyal (2020), the Court held that where substantial compliance is shown and authenticity is undisputed, the absence of a certificate does not invalidate the Record of Proceedings.

“Even while giving reply to the show cause notice, the contents of such statements recorded under Section 108 of the Act, 1962 were not disputed. This, of course, would be relevant only insofar as determining whether there has been due compliance of Section 138C(4) of the Act, 1962 is concerned. The evidentiary value of such Section 108 statements in any other proceedings, if any would have to be considered in accordance with law, including the compliance of Section 138B of the Act, 1962.”, the court said.

Accordingly, the appeal was allowed.

“The judgment and order passed by the Tribunal is hereby set aside. The appeals filed by the assessees before the Tribunal are ordered to be restored to its original file and to be reheard by the Tribunal on grounds other than Section 138C(4) of the Act, 1962.”, the Court ordered.

Cause Title: ADDITIONAL DIRECTOR GENERAL ADJUDICATION, DIRECTORATE OF REVENUE INTELLIGENCE VERSUS SURESH KUMAR AND CO. IMPEX PVT. LTD. & ORS.

Click here to read/download the order

Ms. Nisha Bagchi, Sr. Adv. argued for the Revenue, and Mr. Ashish Batra, Adv. argued for the assesses