- Home

- /

- Supreme court

- /

- S. 31(7)(b) Arbitration Act | Claim...

S. 31(7)(b) Arbitration Act | Claim For Additional Post-Award Interest Barred When Award Fixes Rate Until Payment : Supreme Court

Yash Mittal

24 Sept 2025 6:50 PM IST

The Supreme Court on Wednesday (Sep. 24) held that if an arbitral award provides a composite interest rate covering the entire period from the cause of action to payment, the award holder cannot claim additional compound interest at the post-award stage under Section 31(7)(b) of the Arbitration and Conciliation Act, 1996 (“Act”). Section 31(7)(b) of the Act provides for post-award...

The Supreme Court on Wednesday (Sep. 24) held that if an arbitral award provides a composite interest rate covering the entire period from the cause of action to payment, the award holder cannot claim additional compound interest at the post-award stage under Section 31(7)(b) of the Arbitration and Conciliation Act, 1996 (“Act”).

Section 31(7)(b) of the Act provides for post-award interest at 18% from the date of the award until payment. However, if the arbitral award specifies a composite rate of interest, the award holder cannot claim additional 18% compound interest under this provision. In such cases, the interest is governed solely by the rate in the award, as Section 31(7)(b) applies “unless the award otherwise directs.” In this case, the award expressly set interest at 21% until repayment, therefore the question of awarding post-award interest would not arise, the court said.

The dispute arose from a Memorandum of Understanding (MoU) for the sale of land. Under Clause 6(b) of the MoU, the appellant had agreed to refund an advance paid by the respondent, along with interest at 21% per annum from the dates of disbursement until actual repayment, in case of termination.

The arbitral tribunal, respecting this contractual term, awarded a composite interest @21% per annum from the date of advance until repayment. However, during execution, the decree-holder claimed entitlement to compound interest @18% ("interest upon interest") by invoking Section 31(7)(b) of the Act and placing reliance on Hyder Consulting (UK) Ltd. v. Governor, State of Orissa, (2015) 2 SCC 189. The Executing Court rejected this claim, but the High Court remanded the matter, leading to the present appeal before the Supreme Court.

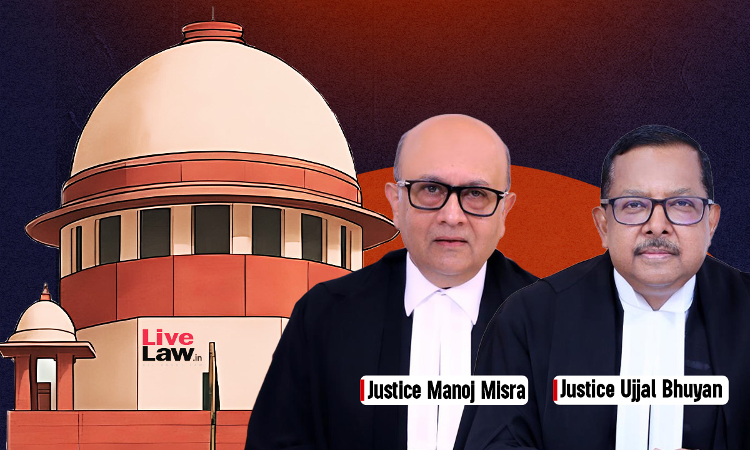

Setting aside the High Court's decision, a bench of Justice Manoj Misra and Justice Ujjal Bhuyan restored the decision of the executing court, holding that an award-holder cannot seek "compound interest" under Section 31(7)(b) of the Arbitration and Conciliation Act, 1996, when the arbitral tribunal has already awarded a composite rate of interest until the date of payment.

“As the arbitral tribunal had expressly provided interest till the date of repayment, question of additional or compound interest under clause (b) of sub-section (7) of Section 31 of 1996 Act would not arise.”, the court said.

“The MoU did not stipulate compounding of interest; the arbitral tribunal did not award compound interest; therefore, respondent cannot at the stage of execution seek to introduce claim of compound interest by drawing on general principles. Allowing such a claim would amount to rewriting the award at the stage of execution which is impermissible.”, the court said.

The judgment authored by Justice Bhuyan clarified that the principle in Hyder Consulting relied upon by the Respondent applies only when the arbitral award is silent on post-award interest. In such a scenario, the default statutory rule kicks in. However, when the award itself provides a specific interest directive for the post-award period, as it did here by using the phrase "till the date it is repaid", the award itself becomes the governing law between the parties for the interest calculation.

“Therefore, reliance placed by the respondent on Hyder Consulting (supra) to claim post-award interest is misplaced. That principle would apply only when the arbitral tribunal leaves a matter unqualified or is silent. In the present case the arbitral tribunal bound by the MoU and exercising its statutory discretion had already specified the interest rate (21% per annum) and the duration (until repayment). As held in Morgan Securities and Credits Private Limited (supra), reaffirmed in Delhi Airport Metro Express Private Limited (supra) and explained in S.A. Builders Limited (supra), once parties agree on the interest regime, the arbitrator's role is confined to enforcing it and the courts would not rewrite or enlarge the award by introducing further interest at the execution stage.”, the court said.

Accordingly, the appeal was allowed.

Cause Title: HLV LIMITED (FORMERLY KNOWN AS HOTEL LEELAVENTURE PVT. LTD.) VERSUS PBSAMP PROJECTS PVT. LTD.

Citation : 2025 LiveLaw (SC) 944

Click here to read/download the judgment

Appearance:

For Petitioner(s) : Mr. Dama Seshadri Naidu, Sr. Adv. Mr. Hemandranath Reddy, Sr. Adv. Mr. M Srinivas R Rao, Adv. Mr. M.V. Mukunda, Adv. Mr. Abid Ali Beeran P, AOR Mr. Sarath S Janardanan, Adv. Mr. Saswat Adhyapak, Adv. Ms. Namita Kumari, Adv.

For Respondent(s) : Mr. P.b. Suresh, Sr. Adv. Mr. Mayank Jain, Adv. Mr. Madhur Jain, Adv. Ms. Aakriti Dhawan, Adv. Mr. Arpit Goel, Adv. Mr. Deepak Jain, Adv. Mr. Parmatma Singh, AOR