- Home

- /

- Supreme court

- /

- Vehicles Plying Only Within...

Vehicles Plying Only Within Enclosed Premises Of Factory/Plant Not Liable To Pay Motor Vehicle Tax : Supreme Court

Yash Mittal

30 Aug 2025 12:26 PM IST

The Supreme Court on Friday (Aug. 29) ruled that the vehicles operating exclusively within the enclosed premises of a factory or plant are not liable to pay motor vehicle tax, as such areas do not constitute a "public place." “Motor vehicle tax is compensatory in nature. It has a direct nexus with the end use. The rationale for levy of motor vehicle tax is that a person who is using...

The Supreme Court on Friday (Aug. 29) ruled that the vehicles operating exclusively within the enclosed premises of a factory or plant are not liable to pay motor vehicle tax, as such areas do not constitute a "public place."

“Motor vehicle tax is compensatory in nature. It has a direct nexus with the end use. The rationale for levy of motor vehicle tax is that a person who is using public infrastructure, such as, roads, highways etc. has to pay for such usage. Legislature has consciously used the expression 'public place' in Section 3 (“AP Motor Vehicle Taxation Act”). If a motor vehicle is not used in a 'public place' or not kept for use in a 'public place' then the person concerned is not deriving benefit from the public infrastructure; therefore, he should not be burdened with the motor vehicle tax for such period.”, the court said.

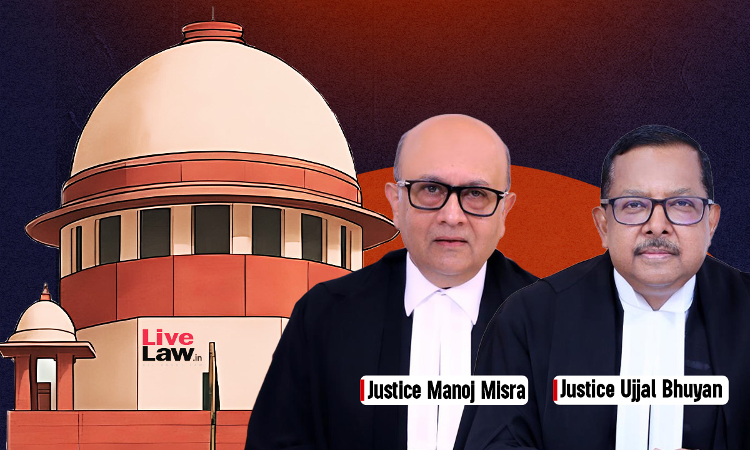

The bench comprising Justices Manoj Misra and Ujjal Bhuyan delivered the judgment in the context of Andhra Pradesh Motor Vehicle Taxation Act, 1963 (“Act”), strictly interpreting its charging Section which states that tax would be levied on vehicles "used or kept for use in a public place." Relying on the Motor Vehicles Act, 1988, the Court defined "public place" as a space "to which the public have a right of access."

The Court referred to Section 2(34) of the Motor Vehicles Act, which defines "'public place" to means a road, street, way or other place, whether a thoroughfare or not, to which the public have a right of access, and includes any place or stand at which passengers are picked up or set down by a stage carriage.

The dispute arose from a contract between Appellant and the Respondent- Visakhapatnam Steel Plant (RINL) for logistical work within the plant's central dispatch yard. The company deployed 36 vehicles which, from April 2021, operated solely inside the steel plant's premises, an area surrounded by compound walls with access controlled by CISF personnel. The vehicles never plied on public roads.

Believing this exclusive internal use made them exempt, Appellant sought relief from paying motor vehicle tax. The State Transport Department rejected the request and demanded over ₹22 lakh, which the company paid under protest. The Andhra Pradesh High Court's Division Bench later upheld this demand, leading to the appeal in the Supreme Court.

Setting aside the High Court's decision, the judgment authored by Justice Bhuyan held that the Respondents secured, access-controlled steel plant premises, guarded by CISF, was unequivocally not a public place, regardless of it being owned by a government company.

“Requirement of law is that the motor vehicle should be used or kept for use in a 'public place'. When admittedly the motor vehicles of the appellant were confined for use within the RINL premises which is a closed area then question of the vehicles being used or kept for being used in a 'public place' does not arise.”, the court said.

“In the instant case, the motor vehicles in question were used or kept for use only within the restricted premises of RINL which is not a 'public place'. Therefore, the said vehicles are not liable to be taxed for the period the said vehicles were used or kept for use within the restricted premises of RINL. Argument of the respondent that appellant had not intimated non-use of the motor vehicles in terms of Rule 12A does not carry much persuasion in view of what we have discussed supra. Thus, even in the absence of any intimation in terms of Rule 12A, motor vehicles of the appellant cannot be subjected to motor vehicle tax for the period those were used or kept confined within the restricted premises of RINL.”, the court added.

Accordingly, the appeal was allowed.

Cause Title: M/S. TARACHAND LOGISTIC SOLUTIONS LIMITED VERSUS STATE OF ANDHRA PRADESH & ORS.

Citation : 2205 LiveLaw (SC) 852

Click here to read/download the judgment

Appearance:

For Petitioner(s) : Mr. Vijay Hansaria, Sr. Adv. Mr. Sanjay Sarin, Adv. Ms. Gagan Deep Kaur, Adv. Ms. Kavya Jhawar, Adv. Mr. Preshit D. Bagul, Adv. Mr. Dinkar Kalra, AOR

For Respondent(s) : Ms. Prerna Singh, Adv. Mr. Guntur Pramod Kumar, AOR Mr. Dhruv Yadav, Adv.