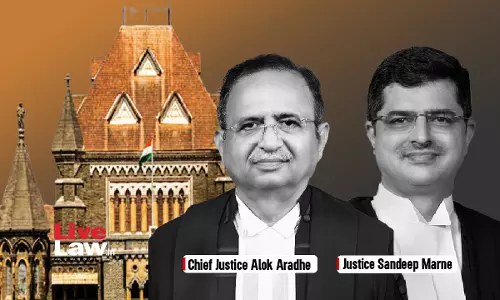

Bombay High Court

'Mere Absence Of Party From Court On A Few Occasions Is Not Sufficient To Dismiss Case For Non-Prosecution': Bombay High Court

The Bombay High Court has held that a complaint cannot be dismissed for non-prosecution under Section 256 of the Code of Criminal Procedure merely because the complainant or counsel was absent on a few dates of hearing. The Court observed that principles of natural justice require giving the complainant a fair opportunity to prosecute the complaint on the merits, and that a harsh or hyper-technical approach should be avoided.Justice M. M. Nerlikar was hearing a criminal appeal filed challenging...

Ambiguous Terms Of An Insurance Policy Must Be Interpreted To Favour The Insured: Bombay High Court

The Bombay High Court has held that in cases of ambiguity in an insurance policy, the principle of contra proferentem would apply and the terms must be interpreted in favour of the insured. The Court expressed serious concern over the conduct of TATA AIG General Insurance Company in repudiating the claim of a widow whose husband had availed a compulsory credit-linked insurance policy bundled with his housing loan, observing that the company had attempted to escape its obligations by taking a...

Centre Notifies Permanent Appointments For 6 Additional Judges Of Bombay High Court

The Central Government on Wednesday (September 10) notified the permanent appointments for 6 additional judges of the Bombay High Court. The notification issued by the Ministry of Law and Justice states:"In exercise of the power conferred by clause (1) of Article 217 of the Constitution of India, the President is pleased to appoint S/Shri Justices (i) Justice Sanjay Anandrao Deshmukh, (ii) Justice Smt. Vrushali Vijay Joshi, (iii) Justice Abhay Jainarayanji Mantri, (iv) Justice Shyam...

'Political Decision': Plea In Bombay High Court Challenges State Govt's Move To Give 'Kunbi' Certificates To Maratha Community

A Trust working for the welfare of the Veershaivya Lingayat community and its sub-castes, have petitioned the Bombay High Court through a Public Interest Litigation, challenging the decision of the Maharashtra government to issue Kunbi caste certificates to the Maratha community for availing reservation in education and public service. The Pune based Trust - Shiva Akhil Bhartiya Veershaiva...

"Is Humanity Put To Rest?" Bombay High Court Slams Prison Authorities For Failing To Release Ramesh Gaichor Despite Temporary Bail

Asking if the State has put 'humanity' to rest, the Bombay High Court on Wednesday pulled up the Maharashtra Police and also the Prison Authorities for not releasing Ramesh Gaichor, one of the accused in the Bhima Koregaon - Elgar Parishad case, who was last month granted a temporary bail of three days to meet his ailing father in Pune.A division bench of Justices Ajay Gadkari and...

Bombay High Court Grants Bail To Accused In 2012 Pune Serial Blasts Case

The Bombay High Court on Tuesday (September 9) granted bail to one of the accused in the 2012 serial bomb blasts case in Pune on the ground of delayed trial.Five low intensity explosions took place in Pune City on the evening of August 1, 2012, in which one person was injured. Apart from five bomb blasts, one live bomb was found in the carrier basket of Hero Street Ranger black colour...

Bombay High Court Asks Mumbai Police Not To File Chargesheet Against Kannada Actor Dhruva Sarja In Cheating Case

In a temporary respite for popular Kannada actor Dhruva Sarja alias Dhruva Kumar, the Bombay High Court on Tuesday ordered the Mumbai Police not to file chargesheet in a criminal case lodged against him by filmmaker Raghavendra Hegde for allegedly duping him of Rs 9 crore.A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad passed an order directing the Mumbai...

2008 Malegaon Blast: Victims Move Bombay High Court Challenging Special Court Order Acquitting Pragya Thakur, Other Accused

Victims of the 2008 Malegaon Bomb Blast case have moved the Bombay High Court challenging the judgment of the special court which had acquitted all the accused in the case including former BJP leader Pragya Thakur and Lt Col Prasad Purohit.The appeal filed by Nisar Ahmed Sayyed Bilal, is likely to be heard by a division bench of Justices Ajay Gadkari and Ranjitsinha Bhonsale, on September...

'Emotional Attachment' Of Child With Grandparents Is No Ground To Deny Custody To Biological Parents: Bombay High Court

A child's custody cannot be given to his grandparents just because there is an emotional attachment and the same does not confer any 'superior' right to custody over that of the biological parents, the Bombay High Court held on September 4 (Thursday) while allowing a father's habeas corpus plea to get the custody of his son. A division bench of Justices Ravindra Ghuge and Gautam Ankhad noted...

Bombay High Court Orders Man To Do Cleaning & Mopping At Mumbai's JJ Hospital For Filing Bogus FIR Against Zee TV Show

The Bombay High Court recently ordered a man to do cleaning and mopping work at the government-run JJ hospital after noting that he had filed a bogus complaint against Zee TV for its new show titled 'Tum Se Tum Tak' which revolves around the love story of a nearly 46-year-old man and a 19-year-old girl.A division bench of Justices Ravindra Ghuge and Gautam Ankhad was hearing a petition filed...

'Creating Additional Tehsildar Office Does Not Tantamount To New Revenue Area Under Maharashtra Land Revenue Code': Bombay High Court

The Bombay High Court has held that the creation of an office of an Additional Tehsildar for administrative convenience does not amount to the creation or constitution of a new revenue area under Section 4 of the Maharashtra Land Revenue Code, 1966. The Court clarified that such appointments are permissible under Sections 7 and 13 of the Code and do not require compliance with...

AO Can Determine Annual Value Of Property Higher Than Municipal Rateable Value U/S 22 Income Tax Act: Bombay High Court

The Bombay High Court stated that the assessing officer (AO) can determine the annual value of the property higher than the municipal rateable value under Section 22 of the Income Tax Act. Section 22 of the Income Tax Act, 1961 deals with the "taxability of 'Income from House Property”. It says the annual value of property consisting of any buildings or lands appurtenant thereto...