Bombay High Court

Bombay High Court Dismisses Nawazuddin Siddiqui's Suit Demanding ₹100 Crore From His Brother & Ex-Wife

The Bombay High Court on Friday dismissed the civil suit filed by Actor Nawazuddin Siddiqui against his brother Shamasuddin Siddiqui and his wife Anjana Pandey, demanding Rs 100 crore in damages for alleged defamation and loss of reputation.Single-judge Justice Jitendra Jain dismissed the suit for non-prosecution. However, a detailed copy of the order is yet to be made available.According to...

Bollywood Actor Suniel Shetty Moves Bombay High Court Against His Deepfake Images

Bollywood actor Suniel Shetty has moved the Bombay High Court seeking protection of his personality rights. He has asked the court to restrain the circulation of deepfake images and videos featuring him and his family across social media platforms.Shetty has also sought directions to take down his unauthorised photographs used on commercial websites, including gambling and astrology platforms....

CBI Has Accepted Judgment In Sohrabuddin Encounter Case, Yet To Decide Whether To Challenge It Or Not: CBI Tells Bombay High Court

The Central Bureau of Investigation (CBI) on Wednesday told the Bombay High Court that it has "accepted" the December 13, 2018 judgment of a special court, which acquitted 22 policemen from the alleged "fake" encounter case of Sohrabuddin Sheikh, his wife Kausar Bi and associate Tulsiram Prajapati. A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam...

Input Tax Credit Can't Be Blocked If Credit Balance Is Nil: Bombay High Court

The Bombay High Court on Tuesday held that Input Tax Credit (ITC) cannot be blocked under Rule 86-A of the Central Goods and Services Tax Rules, 2017, if the electronic credit ledger of a taxpayer shows a nil balance on the date of the blocking order. A Division Bench of Justice M S Sonak and Justice Advait M Sethna observed, “Therefore, on a plain reading of the rule, if on...

Bombay High Court Denies Zanmai Labs' Plea Against Arbitral Tribunal's Order To Provide Bank Securities In WazirX Crypto Theft Case

The Bombay High Court has dismissed a challenge by Zanmai Labs, the company that co-operates the WazirX cryptocurrency platform, against interim orders passed by an arbitral tribunal directing it to provide bank securities for investor claims in the aftermath of a cyber attack that led to a Rs 2,000 crore ($234 million) loss.The tribunal's directions required Zanmai to furnish bank guarantees...

Mere Use Of Abusive Or Defamatory Language Not Sufficient To Constitute Offence U/S 294 IPC: Bombay High Court

The Bombay High Court has held that the mere use of abusive, filthy, or defamatory language is not sufficient to constitute an offence under Section 294 of the Indian Penal Code (IPC) unless the act is obscene and causes annoyance to others in or near a public place. The Court reiterated that annoyance and obscenity are both essential ingredients of the offence and must be...

Bombay High Court Grants Ad-Interim Relief To Reliance In 'JIO' Trademark Infringement Suit Against Cab Operators

The Bombay High Court on Tuesday granted an ad-interim injunction to Reliance Industries Limited, restraining the use of its registered 'JIO' trademark by parties offering taxi services under the domain name www.jiocabs.com.A bench of Justice Somasekhar Sundaresan observed that Reliance had made out a strong prima facie case and observed that continued use of a well-known brand could...

"Deposit ₹60 Crore First": Bombay High Court Tells Shilpa Shetty & Raj Kundra In Plea Seeking Permission For Foreign Trip

The Bombay High Court on Wednesday (October 8) asked Actor Shilpa Shetty and her businessman husband Raj Kundra to deposit Rs 60 crore if they wanted the court to consider their plea to travel to Los Angeles and other foreign countries for business and personal reasons.This comes after the couple moved the High Court seeking quashing of a Look Out Circular (LOC) issued against them over an...

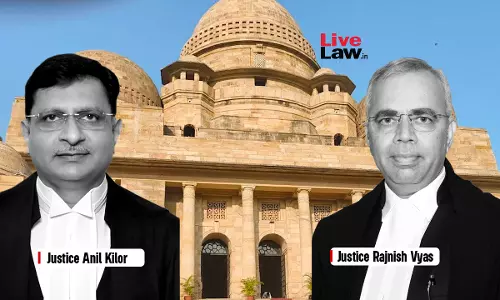

Citizens Can't Claim Absolute Right To Visit Public Offices: Bombay High Court

In an important order, the Bombay High Court recently held that no citizen can claim an absolute right to visit public offices purportedly for lodging complaints.A division bench of Justices Anil Kilor and Rajnish Vyas, sitting at the Nagpur seat, upheld the decision of the Western Coalfields Ltd. which declared one Kishore Chakole as "Persona Non Grata" thereby prohibiting his entry in...

Non-Use Of Mandatory Portal Can't Be Ground To Reject Appointment When Portal Was Non-Functional: Bombay HC

A Division bench of the Bombay High Court comprising Justice M. S. Karnik and Justice Sharmila U. Deshmukh held that rejection of a teacher's appointment approval was unsustainable because the mandatory 'Pavitra Portal' was non-functional at the time of recruitment, and the Education Officer failed to respond to the school's prior communications. Background Facts A vacancy...

Any Person In Control Of Company Is Liable To Face Penal Measures If Account Is Declared Fraud: Bombay High Court In Ambani's Case

While dismissing the plea filed by industrialist Anil Ambani, the Bombay High Court held that whenever a company's account is classified as "fraud" its Promoters, Directors or anyone having control over the said company, automatically become liable to penal actions as mandated under the Reserve Bank of India (RBI) Master Directions, 2024.Notably, Ambani and his company Reliance...

Bombay High Court Refuses To Stay Maharashtra Govt Resolution Granting OBC Status To Kunbi-Maratha Communities, Seeks State's Response

The Bombay High Court has declined interim relief in pleas seeking a stay on a September 2 Government Resolution (GR) by the Maharashtra Government by which it decided to confer Kunbi, Maratha-Kunbi and Kunbi-Maratha under the Other Backward Classes (OBC) category. A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad, however, ordered the State's Social...