Tax

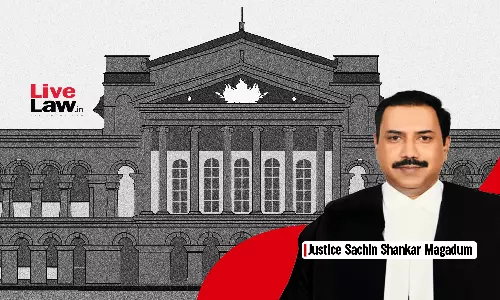

Ad Tax Cannot Be Imposed On Educational Institutions For Putting Up Non-Commercial Signages On Their Property: Karnataka High Court

The Karnataka High Court has set aside an advertisement tax demand notice issued by the Bruhat Bengaluru Mahanagara Palike (BBMP) to an educational institution for displaying non-commercial signage and boards on its own property.Justice Sachin Shankar Magadum held thus while allowing the petition filed by BS Gupta, Secretary of Gupta Education Trust, who had challenged the legality/validity...

No Right To Reinstatement Of Customs Broker License After Breach Of Trust With Customs Department: Kerala High Court

The Kerala High Court stated that no right to reinstatement of customs broker license after breach of trust with customs department. Justices A.K. Jayasankaran Nambiar and P.M. Manoj stated that “…..the relationship between the Customs Department and the Customs Broker appointed in terms of the Regulations is essentially one of trust. Once that trust is broken, and the Customs...

Taxpayers With Pending Appeals Eligible For 50% Relief Under 2020 Samadhan Scheme: Madhya Pradesh High Court

The Madhya Pradesh High Court stated that taxpayers with pending appeals are eligible for 50% relief under the 2020 Samadhan Scheme (The Madhya Pradesh Karadhan Adhiniyamon Ki Puranee Bakaya Rashi Ka Samadhan Adhyadesh, 2020). Justices Vivek Rusia and Binod Kumar Dwivedi observed that the assessee's case is pending before the appellate authority, and the department wrongly considered...

DTAA Prevails Over S.206AA Of Income Tax Act For TDS On Payments To Non-Residents Without PAN: Gujarat High Court

The Gujarat High Court stated that DTAA (Double Taxation Avoidance Agreement) prevails over Section 206AA of Income Tax Act for TDS on payments to non-residents without PAN. Justices Bhargav D. Karia and Pranav Trivedi was addressing the appeals pertains to alleged short deduction of TDS and raising demand by invoking provisions of section 206AA of the Income Tax...

Luxury Tax U/S 5A Of Kerala Building Tax Act Is Constitutionally Valid, However, Demand Beyond 3 Years Is Unsustainable: Kerala High Court

The Kerala High Court stated that luxury tax under Section 5A Of Kerala Building Tax Act is constitutionally valid post 101st Amendment to the Constitution but a demand that extends to more than three years prior to the date of the demand notice cannot be legally sustained. Justices A.K. Jayasankaran Nambiar and P.M. Manoj opined that “Entry 49 of List II of the 7th Schedule to...

S.130 CSGT Act | Absence Of Express Reference To Conveyance In Confiscation Order Does Not Exclude It From Confiscation: Kerala High Court

The Kerala High Court stated that absence of an express reference to the conveyance in the confiscation order does not exclude it from confiscation. Justice Ziyad Rahman A.A. stated that merely because of the reason that, while ordering the confiscation in the order, the conveyance was not specifically included, it cannot be assumed that, the conveyance of the assessee was...

Assessment Proceedings Against Deceased Person Invalid Without Notice To Legal Heirs U/S 93 Of CGST Act: Kerala High Court

The Kerala High Court stated that assessment proceedings against deceased person invalid without notice to legal heirs under Section 93 CGST Act. Justice Ziyad Rahman A.A. addressed the issue where the wife of the deceased, challenged the GST DRC-07 summary order issued in the name of her deceased husband. The wife/petitioner has challenged the orders on the ground that,...

Battery Packs Imported To Manufacture Phones Fall Under 12% GST Category: CESTAT Allows Samsung's Appeal

The Customs, Excise & Service Tax Appellate Tribunal at Delhi has held that lithium-ion batteries used for the manufacture of mobile phones up to March 31, 2020 would attract 12% GST.A Bench of Justice Dilip Gupta (President) and Hemambika R. Priya (Technical Member) added that if lithium-ion batteries were not used in the manufacture of mobile phones, they would attract 28% GST up to...

Tax Weekly Round-Up: June 23 - June 29, 2025

HIGH COURTSBombay HCBenefit Of Cash Compensatory Scheme Cannot Be Denied On Castor Oil Exports Based On Subsequent Test Change: Bombay High CourtCase Title: Sanjay Kumar Agarwal v. Union of IndiaCase Number: WRIT PETITION NO.872 OF 1994The Bombay High Court stated that benefit of cash compensatory scheme benefit cannot be denied on castor oil exports based on subsequent test change.The...

Goods Confiscated U/S 130 Of GST Act Can Be Released During Pendency Of Appeal If Not Auctioned: Kerala High Court

The Kerala High Court has stated that goods confiscated under Section 130 GST Act can be released during pendency of appeal if not yet auctioned. Justice Ziyad Rahman A.A. was addressing the case where the grievance of the assessee/petitioner is against confiscation order passed by the Enforcement Officer/2nd respondent, under Section 130 of the GST...

GST | Alleging Denial Of Hearing Insufficient If Assessee Itself Wasn't Diligent In Responding To SCN Or Attending Hearing: Delhi High Court

The Delhi High Court has refused to interfere with a demand order passed by the GST Department without hearing the assessee, after noting that the assessee itself was not diligent in responding to the show cause notice or attending the personal hearing despite notice.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Considering the fact that (i) The...

Assessment Based On DVO's Valuation Cannot Be Revised U/S 263 Of Income Tax Act In Absence Of Concrete Material: Kerala High Court

The Kerala High Court held that assessment based on DVO's (Department Valuation Officer) valuation cannot be revised under Section 263 of Income Tax Act in absence of concrete material. Justices A.K. Jayasankaran Nambiar and P.M. Manoj observed that “as on the date of invoking his power under Section 263 of the IT Act, the Commissioner could not have had a 'reason to believe' that...