Tax

No CENVAT Credit On Note Sheets And Sanction Orders; Valid Documents With Mandatory Details Required: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that CENVAT Credit can't be claimed on note sheets and sanction orders and required valid documents with mandatory details. Dr. Rachna Gupta (Judicial Member) and P.V. Subba Rao (Technical Member) stated that it is not open to the assessee to take CENVAT credit on the basis of note sheets...

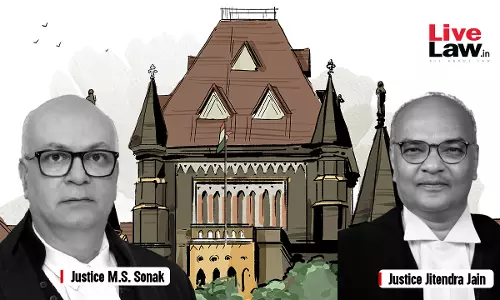

GST Order Can't Be A Copy-Paste Of Showcause Notice, Independent Reasoning Must Be Present: Bombay High Court

The Bombay High Court held that a GST order can't be a copy-paste of the show cause notice and that independent reasoning must be present. Justices M.S. Sonak and Jitendra Jain stated that “simply cutting and pasting the allegations in the show cause notice or mechanically reciting them verbatim does not inspire confidence that due consideration has been shown to the cause, and...

GST TRAN-I Credit Can Be Revised Based On Manually Filed Excise Return: Bombay High Court

The Bombay High Court held that GST TRAN-I credit can be revised based on manually filed ER-1 Return. Justices M.S. Sonak and Jitendra Jain stated that “there were technical issues with respect to revising TRAN-1 and non-availability of electronic mode to revise excise return and it is only after directions issued by the Supreme Court in the case of Union of India vs. Filco...

GST Notice U/S 79(1)(c) Can't Be Issued Directly To Bank; Must Be Served To Actual Taxpayer: Bombay High Court

The Bombay High Court held that a GST notice under Section 79(1)(c) of the CGST Act can't be issued directly to the bank. Justices M.S. Sonak and Jitendra Jain observed that the notice under Section 79(1)(c) of the CGST Act was not addressed to the assessee but directly to the bank. “Where such notice is served on a person, he can prove to the satisfaction of the officer...

Customs Act | Mere Purchase Of Gold Without Bill Not Enough To Prove Gold Smuggling: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that mere purchase of gold without bill not enough to prove gold smuggling. Dr. Rachna Gupta (Judicial Member) opined that the mere act of purchasing gold without bill is highly insufficient to confirm the grave allegations of conspiring the act of smuggling of gold. The order...

Service Tax To Be Paid By Distributor, Not By Theatre Owner For Film Screening: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that service tax has to be paid by the distributor under “Copy Right Service” for transfer of right by licence to screen the film in the theatre of the owner. Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) stated that “the purpose of the agreement and the...

GST Payable On Rent For Hotels Hired By Govt For Security Forces, Liability Of Home Dept To Reimburse: J&K High Court

The Jammu and Kashmir High Court has held that the Department of Home is liable to reimburse GST in addition to the fixed rent to hotel owners whose accommodations have been requisitioned for housing security forces.The petitioner had filed the petition seeking a direction that the tax amount be paid or reimbursed separately by the Home Department over and above the fixed rent. A bench...

Section 80IA Income Tax Act | Internal CUP Method Is Most Appropriate For ALP Determination In Captive Power Transactions: Calcutta High Court

The Calcutta High Court held that Internal CUP (Comparable Uncontrolled Price) method is most appropriate for ALP (Arm's Length Price) determination in captive power transactions. Chief Justice T.S. Sivagnanam and Justice Chaitali Chatterjee (Das) was addressing issue of whether the Internal Comparable Uncontrolled Price (CUP) method adopted by the assessee was right in determining...

Insurance Claim Received On Dead Horses Is Capital Receipt, Not Taxable As Income U/S 41(1): Bombay High Court

The Bombay High Court held that insurance claim received on dead horses is capital receipt, not taxable as income under Section 41(1) Of Income Tax Act. The bench opined that horses in respect of which the insurance claim was received were Assessee's capital assets and that therefore insurance receipt arising therefrom could only have been considered as capital receipt, not...

[Income Tax Act] Amount Indicated In P&L Account As Provision For Doubtful Debts/Advances Cannot Be Treated As "Reserve" U/S 115JA: Bombay HC

The Bombay High Court has ruled that a provision for doubtful debts cannot be treated as either a "reserve" or a "provision for liability" under clauses (b) or (c) of the Explanation to Section 115JA of the Income Tax Act, 1961, and thus cannot be added back to the book profits for the purpose of minimum alternate tax (MAT). The Court accordingly overturned the addition of ₹2.49 crore made...

No Service Tax On 'Upfront Fee' Received By DMRC From Customers Under Concession Agreement: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that no service tax on 'upfront fee' received by DMRC (Delhi Metro Rail Corporation) from customers under concession agreement. Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) was addressing the issue of whether the “upfront fee” received by the Delhi Metro...

Goods Not Prohibited Under Foreign Trade Policy Still Require Valid IEC; Import Using Bogus Codes Impermissible: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that goods not prohibited under foreign trade policy still require valid IEC (Importer Exporter Codes), import using bogus codes is impermissible. Dr. Rachna Gupta (Judicial Member) and P.V. Subba Rao (Technical Member) observed that there is nothing in the FTDR Act (The Foreign...