- Home

- /

- Top Stories

- /

- Appointment Of Senior Practitioners...

Appointment Of Senior Practitioners At ITAT Should Be Timely, Not At Very End Of Their Professions: CJI BR Gavai

Nupur Thapliyal

9 Oct 2025 10:15 AM IST

CJI BR Gavai on Wednesday said that the eligibility criteria for appointment of senior practitioners at the Income Tax Appellate Tribunal (ITAT) should be timely, where their experience can be applied effectively and not at the very end of their careers. Underscoring that the appointment procedures at ITAT must remain transparent, CJI said:“Eligibility criteria should be adapted to...

CJI BR Gavai on Wednesday said that the eligibility criteria for appointment of senior practitioners at the Income Tax Appellate Tribunal (ITAT) should be timely, where their experience can be applied effectively and not at the very end of their careers.

Underscoring that the appointment procedures at ITAT must remain transparent, CJI said:

“Eligibility criteria should be adapted to attract senior practitioners at a point in their careers where their experience can be effectively applied, rather than deferring appointments to the very end of their professional lives.”

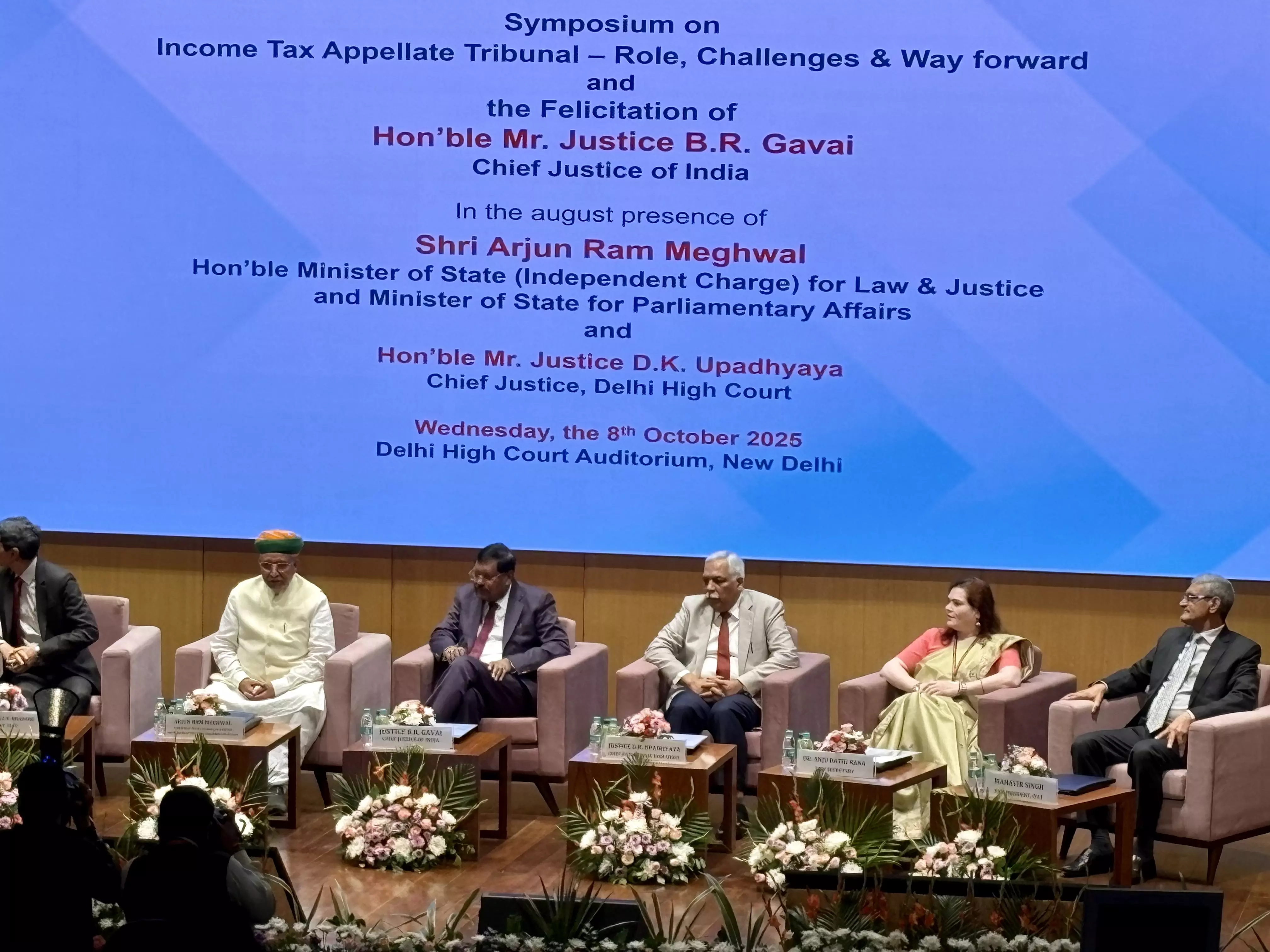

CJI was speaking at an event- “Symposium of ITAT- Role, Challenges and Way Forward.” The event was also for his felicitation.

Arjun Ram Meghwal- Minister of State, Ministry of Law & Justice was the Chief Guest for the event. Other dignitaries were Delhi High Court Chief Justice DK Upadhyaya, ITAT President- Justice (Retd.) C.V. Bhadang, President of ITAT Tax Bar Association- Ajay Wadhwa and Law Secretary- Dr. Anju Rathi Rana.

On the appointment procedures at ITAT, CJI said that the credibility of a tribunal fundamentally relies on public confidence that its members are selected according to objective standards rather than transient administrative convenience.

“I would not like to comment on them because the matter is sub-judice. I can only tell the Hon'ble Law Minister that the law has kept the minimum entry at 50 for the ITAT member, I became the High Court Judge at the age of 42,” the judge said.

He added that the tenure arrangements at ITAT should allow sufficient time for the development of adjudicatory expertise and preservation of institutional memory.

Further, the CJI said that a structured programme of induction training, continuing judicial education and focused modules on various aspects, alongside periodic workshops that bring together all the members, officers, and the Bar to discuss practical problems of proof, procedure, and principled reasoning, will reduce the inconsistency of outcomes.

Also speaking at the event, CJ DK Upadhyaya said that CJI Gavai's recent remarks on the functioning of Central Administrative Tribunals, especially on the independence of non judicial members, were well received.

He said that the role of the ITAT is replete with challenges, which are not only limited to sheer complexity of law that it deals with but also include the inherent dichotomy between the tendency of the revenue to overcharge and that of the assessee to find ways to evade the burden.

“We are targeting 5 trillion economy in decades to come and in order to achieve that not only do we need a robust system of contract enforcement but also a predictable and simplified system of taxation,” he said.

Union Law Minister Arjun Ram Meghwal in his speech said that the Income Tax Act of 1961 was amended by the Act of 2025 which is more simplified.

He appreciated the “good synergy” between the four types of people in ITAT- lawyers, judges from the district judiciary, chartered accountants and IRS officers.

Ending his speech, Meghwal congratulated the ITAT for its growth and consistent efforts and also thanked the dignitaries for inviting him.

Also Read: CJI BR Gavai Calls For Reforms In ITAT Appointments, Members' Tenure; Flags Problem Of Conflicting Judgments