- Home

- /

- Top Stories

- /

- Circular Clarifying Previous...

Circular Clarifying Previous Notifications On Fiscal Duty Has Retrospective Effect : Supreme Court

Debby Jain

28 May 2025 9:02 AM IST

The Supreme Court recently held that a circular/notification issued by the revenue department, clarifying or explaining a fiscal regulation, has to be given retrospective effect.In the facts of the case at hand, the Court held that a Circular dated 17.09.2010 issued by the Central Board of Excise and Customs (CBEC) had to be given retrospective effect as it clarified certain...

The Supreme Court recently held that a circular/notification issued by the revenue department, clarifying or explaining a fiscal regulation, has to be given retrospective effect.

In the facts of the case at hand, the Court held that a Circular dated 17.09.2010 issued by the Central Board of Excise and Customs (CBEC) had to be given retrospective effect as it clarified certain previous notifications on customs duty.

It was opined that, being explanatory in nature, the Circular could not be construed as an adoption of a fresh fiscal regime for rebate of customs duty, intended to affect vested rights or impose new burdens upon the Department. "It was passed to resolve the ambiguity qua the meaning & threshold of the previous Notifications", the Court stated.

"the CBEC Circular dt. 17.09.2010 read in conjunction with the previous Notifications already in operation, did not confer a prospective benefit on antecedent facts, but established the scope of the very benefit introduced vide the first Notification No. 81/2006 dt. 13.07.2006 for the sake of the Appellant and such similarly placed exporters. For the same reason, the operation of such a provision or instruction by the Department could only be retrospective in nature, so as to give effect to the objective of the Notifications issued by CBEC", the Court further observed.

In arriving at the decision, reference was made to precedents such as Sree Sankaracharya University of Sanskrit v. Dr. Manu (2023), State of Bihar v. Ramesh Prasad Verma (2017), Commissioner of Income Tax I, Ahmedabad v. Gold Coin Health Food (P) Ltd., etc.

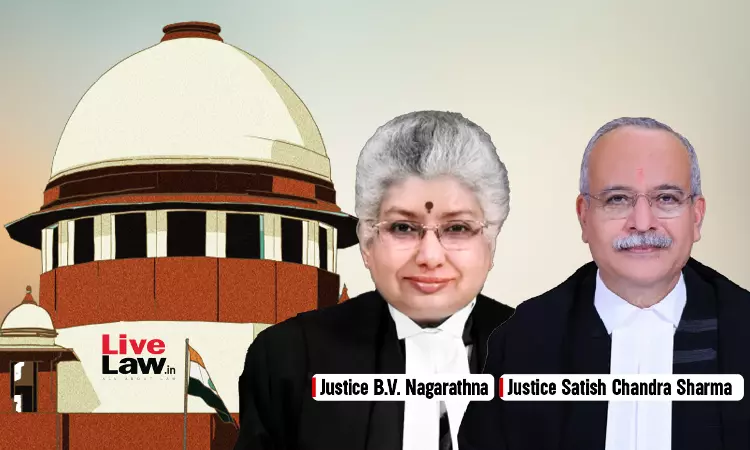

A bench of Justices BV Nagarathna and Satish Chandra Sharma rendered the decision, while dealing with the issue as to whether the 2010 Customs Circular, pertaining to All Industry Rate (AIR) Duty drawbacks, was retrospective in nature.

"It may be argued by the Department that not every beneficial legislation is intended to be retrospective in nature; however, the retrospectivity of a statute is to be tested on the anvil of the doctrine of “fairness”. The substratum of a beneficial legislation is to ensure that the benefit is uniform and absolute, which may be prospective in nature, but when such benefit to one person does not inflict any undue burden on the other, the purposive construction can be considered to be given a retrospective effect", it said.

The bench further noted, "except in cases where such enactments or issuance of Circulars are arbitrary, vexatious or constitute a parallel mechanism making its operation unfair, the Courts need not entertain objections to the operation of a clarificatory/declaratory provision which is only intended to assert & give effect to its parent provision/statute".

Briefly put, the appellant, a merchant-exporter of Soyabean Meal (SBM), claimed entitlement to duty drawbacks at All-Industry Rate (AIR) introduced by a 2006 Customs Notification. The Customs Tariff Act, 1975 permitted 1% AIR duty drawback on the export of SBM and as such, the appellant regularly received benefit of the 1% AIR duty drawback till 2008.

Subsequently, however, the Central Excise authorities decided that manufacturers/exporters were not entitled to the AIR drawback if they had already availed the rebate of central excise duty under Rule 18 or Rule 19(2) of the Central Excise Rules, 2002, and release of the duty drawback to the appellant was withheld.

Eventually, the Central Board of Excise and Customs issued the Clarificatory Circular of 2010, stating that AIR duty drawback towards the customs portion as well as excise duty benefit under Rule 18 or Rule 19(2) of the Central Excise Rules, 2002 were to be simultaneously available.

When the appellant approached the Customs Commissioner seeking disbursement of AIR Duty Drawback prior to 17.09.2010, the benefit was denied stating that effect of the Circular was not retrospective but prospective in nature.

Vide the impugned judgment, the Madhya Pradesh High Court held that the 2010 Customs Circular was prospective in nature. A review petition challenging this decision was also dismissed by the High Court. Aggrieved, the appellant approached the Supreme Court.

After perusing the material, the top Court held that operation of the 2010 Circular ought to be retrospective.

"Having regard to the concerned Circular dt. 17.09.2010 vis-à-vis the previous Notifications, no new right or benefit came to be created, but the actual scope of the benefit accruing to the Appellant and such similarly placed merchant exporters, was explained and settled once and for all. By virtue of the said Circular, it was merely clarified that the benefit of 1% customs duty drawback as indicated under the prior Notification was available to SBM merchants despite having availed CENVAT", it observed.

Ultimately, the orders of the High Court were set aside and the appellant held entitled to the benefit of 1% AIR Customs Duty drawback on its SBM export from 2008 onwards as applicable on retrospective application of the 2010 Circular.

Senior Advocate Arvind P Datar for the appellant.

Advocate Shivank Pratap Singh was arguing counsel for the respondent

Case Title: M/S SURAJ IMPEX (INDIA) PVT. LTD. VERSUS UNION OF INDIA & ORS., SLP (C) Nos. 26178-79 OF 2016

Citation : 2025 LiveLaw (SC) 635